Operational risk capital

Easy does it

Risk management

Back in fashion

Operational risk

Naked to the extreme

Extreme Events

Stable doors and bolting horses

Editor's Letter

The time for using insurance for op risk has come

EDITOR'S LETTER

A calculated approach

Operational risk economic capital calculation is high on the agenda - at last. So who is using it, and why? A new OR&C Intelligence survey investigates

A tough balancing act

The Office of the Comptroller of the Currency, under the watchful eye of deputy comptroller Kevin Bailey, is moving ahead with its Basel II policy. Victoria Pennington reports

Measures for measures

Consistent quantitative operational risk measurement is vital to the health of banks and financial institutions. Andreas Jobst offers guidance on enhanced market practice and risk measurement standards

A narrowing gulf

Many Middle Eastern nations are keen to implement Basel II, and larger banks have been stepping up efforts to develop an op risk framework. But smaller banks are being hindered by a shortage of resources and experienced staff, as Victoria Pennington…

The forensic approach

PROFILE: SEBASTIAN FRITZ-MORGENTHAL

Standing on the threshold

A 'one distribution fits all' approach is not the best option for op risk models. Carsten Steinhoff and Rainer Baule explain why a tailor-made model is therefore vital to the accuracy of loss distribution models

Op risk can learn from Berlin's renaissance

I was in Berlin in June at a conference on business processes. Now, some people might think this is probably not how they would choose to spend their time. But the event was something of a revelation to me.

Defining the boundaries

Him Chuan Lim, Basel II programme director at DBS Bank in Singapore, talks to Ellen Davis about operational risk's complex relationship with both credit risk and market risk

Future options

Operational risk derivatives have been touted for a few years now, but interest in them moves in waves. The current tide is high, however. Duncan Wood tests the water

Room for improvement

Sungard tops our survey of software vendors, its products proving a hit across the op risk and compliance spectrum. But op risk executives continue to demand more from the software industry, reports Dianne See Morrison

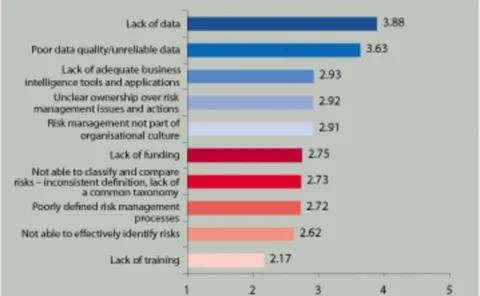

Untangling the risk information knot

In a new OpRisk & Compliance Intelligence survey, sponsored by BearingPoint Management & Technology Consultants, data issues rank high on the risk executive's list of problems. Can Web 2.0 change the face of risk information collection?

A question of discipline

Op risk is showing signs of maturing, although there is still much work to be done. So delivering value to the business continues to be a substantial challenge, according to a new survey

Resolving the confusion

Risk control self-assessments have become a Tower of Babel for the op risk discipline, with a variety of different approaches being taken. Ellen Davis reports

Time for change

Implementation of the core principles of op risk still has a long way to go in the Asia-Pacific region. Ellen Davis reports

Event horizon

Rick Cech takes a second look at what makes up operational risk event types, and asks if there is a more advanced way to define them

Russia opens up

Russia is moving ahead with Basel II implementation, with a new industry working group and new regulatory rules. Ellen Davis reports

The advancing tide of rationalisation

Rationalisation, rationalisation, rationalisation. There is no denying it, this is the major theme in operational risk in the US at the moment, and it is a trend that is spreading to Europe as well.

Operational risk at a crossroads

Just where is operational risk going? This is the question that, in one form or another, seems to be dropping from the lips of most executives in the field these days. People are clearly worried.