Non-modellable risk factors (NMRFs)

Regional banks cheer tweaks to FRTB standardised approach

Planned softening of SBA makes it more appealing, but most banks still expect to adopt IMA

Basel to scrap automatic fails for P&L test

“Amber zone” will protect near-miss desks, but regulators not convinced by NMRF complaints

Global fragmentation looms in FRTB data pooling stand-off

Smaller banks unwilling to hand over localised trade information to data utilities

European FRTB capital charges hang by a thread

EU Council mulls introducing only reporting requirements in CRR II, or a very low scalar

Canada’s banks go it alone with FRTB data utility

Local lenders reject advances of major data utilities to build own solution

FRTB: banks grapple with hard-to-model risks

Swiss, UK bank efforts to comply with regulators’ risks-not-in-VAR rules may be undone by transition to FRTB

Basel delay does not ensure global FRTB consistency

A European Parliament draft would let supervisors decide response to P&L attribution test fails

DTCC muscles in on FRTB data pooling race

Rival to Bloomberg and Markit offerings claims ability to squash banks’ NMRF exposure by 50%

FRTB: industry pushes to use own quotes in risk factor modelling

Isda working group proposes use of own quotes to minimise non-modellable risk factors

FRTB: proxy risk factors may trigger model failures

Swapping non-modellable risk factors for proxies may make it harder to pass P&L attribution test

Asian privacy laws obstruct FRTB data pooling efforts

Bank scepticism and regulatory hurdles likely to inhibit cross-border information sharing

FRTB threatens Canadian bond market, dealers say

Modelling the risk factors of Canadian corporate debt is “almost impossible”

FRTB Special Report 2017

Confronting the challenges of FRTB in P&L attribution, non-modellable risk factors and technology

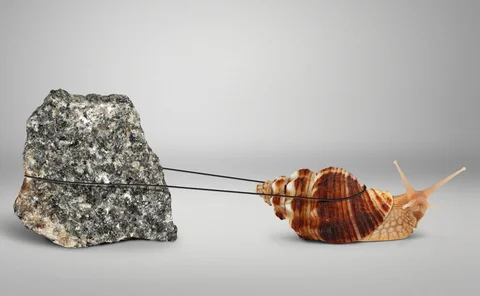

FRTB: a Sisyphean labour

Banks continue to struggle with ever-shifting regulatory parameters

Seizing the opportunity of transformational change

Sponsored Q&A: CompatibL, Murex and Numerix

Solving the FRTB puzzle

Sponsored FRTB forum: IHS Markit

Inconsistent FRTB model guidance vexes dealers

Risk models pulled in opposite directions by P&L attribution test and non-modellable risk factors

FRTB: Basel guidance on backtesting frustrates dealers

Dealers blast “illogical” carve-outs for backtesting exceptions

Identification and capitalisation of non-modellable risk factors

Adolfo Montoro, Tim Becker and Lars Popken propose techniques for systematically capturing and categorising non-modellable risk factors and risk-adequate aggregation

EC gold-plating of FRTB raises risk of global divergence

Some interpret draft CRR II changes to NMRF framework as raising the bar for compliance

FRTB’s risk factor framework is more punitive than it seems

Regime’s constraints may mean risk factors drop in and out of modellability far more frequently than dealers think

FRTB survey: internal model approval tops list of bank fears

Two years on from its devising, chunks of the new market risk framework remain 'unworkable'

FRTB data pooling crawls into action

Dealers voice concerns on data pooling as industry initiative to model risk factors faces significant challenges

Taking the FRTB plunge

Banks entering chilly FRTB waters for first time facing fresh challenges