Mifid

Buy side confronts dealers over unreliable bond prices

Investors are quantifying the quality of indicative prices and banding together to tackle the issue

AFM seeks to ‘level playing field’ for venues and vendors

Dutch regulator suggests some liquidity aggregators should be classified as OTFs

Buy side hopes for best execution reporting carve-out

After EC exempts venues from best execution reporting, Aima hopes RTS 28 reports will be next

CFTC block trade plan gets cold shoulder

Industry divided over swaps reform proposal, and advisory committee casts doubt on need for it

Transparency vs clarity: the Mifid swaps conundrum

Participants want better OTC transparency, but say Esma’s efforts at clarity could muddy the picture

No Mifid equivalence for UK at end of Brexit transition

Footnote reveals assessment delay beyond January 2021, piling pressure on London-based firms

Mifid’s pre-trade transparency is ‘a failed experiment’

Market participants say benefits of altering pre-trade transparency rules are small

‘Improving’ Mifid post-trade transparency splits markets

Mooted changes to Europe’s transparency regime are dividing markets – largely along functional lines

Buy-side firms reject EMS brokerage charges

Some users favour licence fee over per-trade charging – and have forced vendors to switch

Deutsche Börse to exit regulatory reporting business

Pricing war and cost pressures force service providers to reconsider regulatory reporting businesses

Scrutiny and frictions follow EMS vendors into fixed income

Aggregators are facing resistance from venues and attracting the attention of regulators

Spot FX shies away from regulatory yoke

As Europe weighs Aussie-style rules for spot trading, some see benefits – but many fear the burden

EU ‘non-paper’ reveals new effort to delay CCP open access

Negotiations on CCP recovery and resolution could provide a route to postpone Mifid rule

Too much regulation of spot FX could hurt European markets – MEP

A sub-section in the Markets Abuse Regulation could be sufficient oversight, says Ferber

Debelle: regulation could be ‘helpful’ to FX code

As EU weighs regulation of spot market, GFXC chair dismisses key industry argument

Spot FX could be dragged into Mifid II

EC tells Risk.net it is studying Australian-style approach to regulating currency trading

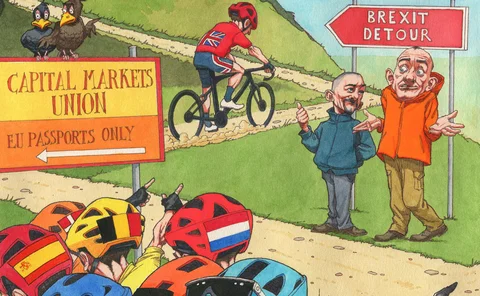

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

New Mifid equivalence rules leave UK firms in limbo

Revised market access rules won’t kick in until six months after UK leaves single market

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

Mifid’s free data mirage vexes markets

Users struggle to access post-trade data despite European regulator’s push for transparency

EU snubs plan to delay CCP open access rules, for now

Attempt to squeeze delay into crowdfunding rules fails, but Mifid review provides last chance

Leaked email reveals new assault on CCP open access rules

Largest group in European Parliament wants to shoehorn delay into crowdfunding legislation

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency