Listed products

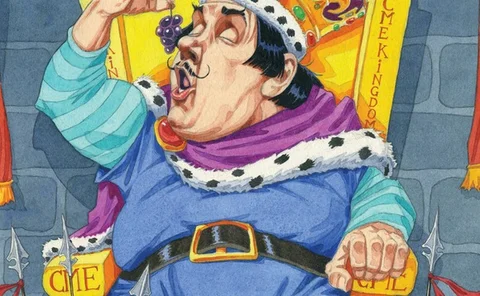

The power behind the throne: CME and the fight for futures market supremacy

It’s the biggest futures exchange in the world, so CME Group naturally has both friends and enemies. Some of its friends are very well connected – and some of its enemies claim this influence has been used to stifle competition, allowing the exchange to…

CME’s new swap future uses Goldman Sachs patent

Licensing agreement could be worth up to 20% of revenues from patented contract, and is seen as an attempt by Goldman Sachs to hedge its bets as new rules threaten OTC market profits

How to mend the Libor process

How to mend the Libor process

Risk 25 firms of the future: Newedge

'Fair and unconflicted' but under pressure

Risk 25 firms of the future: Citadel

OTC market-maker in waiting

Risk 25 firms of the future: BlackRock

‘Jury out’ on OTC derivatives

Risk 25 firms of the future: GFI Group

Exchange ambitions

Risk 25 firms of the future: Eris Exchange

The future of swaps?

Risk 25 firms of the future: CME Group

We are not too big

Risk 25 firms of the future: DTCC

Ready for the horizontal-versus-vertical fight

Risk 25 firms of the future: i-Swap

Asset-class specialists will struggle

Lehman Brothers ruling changes equation for creditors and clients

Protection racket

The ETN that grew too fast

The ETN that grew too fast

Available to trade: row over scope of Dodd-Frank execution rules

Available to trade?

Futures markets could get OTC-style safeguards

Futures market participants expect tougher - and more expensive - collateral protections to be introduced as a result of the MF Global debacle, and the CFTC is ruling nothing out

Exchange of the year: NYSE Liffe US

Risk awards 2012

MF Global: non-US clients caught in cross-border collateral trap

Omnibus structure meant clearing clients of MF Global outside the US were asked to double up on collateral payments. Use of the structure for OTC markets is now in doubt

CFTC urged to rethink rules that threaten cross-margining

Pushed to the margins