Liquidity

Funds warm to Esma liquidity rules after Covid crisis

Funds are embracing stress-testing, and swing pricing, after “a real liquidity crisis” in March

SOFR and credit spread – Not as simple as it seems

Chris Dias, principal and global Libor solution co-lead at KPMG, explores how the market will adjust as liquidity grows and why firms must resist the temptation to default to existing processes for determining credit spread and rethink the traditional…

Investors at the gates: MMF reforms fail the Covid test

After MMF rescues return, regulators urged to rethink rules on gates and sponsor support

A new risk era – Recovering stronger from the pandemic

Jose Ribas, global head of risk and pricing solutions at Bloomberg, discusses how risk management at financial institutions is changing in the wake of the pandemic and the subsequent volatility, the role of regulations and how technology can help risk…

Banks tout early roll dates for FX swaps as quarter-end looms

Asset managers open to more flexible hedging strategies since March turbulence, say dealers

Appetite for renewed Fed dollar swap lines in doubt

With up to $300bn of positions nearing expiry, some say FX swap market can meet banks’ funding needs

Switching CCP – How and why?

As uncertainty surrounding Brexit continues and the impacts of Covid-19-driven market volatility are analysed, it is essential for banks and their end-users to understand their clearing options, and how they can achieve greater capital and cross…

Turkey turmoil opens door to offshore NDF market

Emta invites input on documentation for offshore lira

Margin scuffle at Eurex blurs lines between risk and returns

Disagreement over liquidity risk add-ons may owe more to self-interest than risk management

EU banks’ liquidity buffers weathered Covid turmoil

Central bank cash reserves edge up across EU lenders

At height of Covid crisis, eurozone MMFs scrambled for cash

MMFs hold the bulk of eurozone banks’ commercial paper

Andreas König’s crisis playbook meets Covid-19

Interview: Trading from home may be odd, but Amundi’s FX head was ready for other stresses

Non-operational deposits flooded US G-Sibs in Q1

JP Morgan also sees a big jump in its maturity mismatch add-on

US bank liquidity ratios eroded in Q1

Net cash outflows and HQLA spike to record levels

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

Investors trade the drama out of the crisis

How LGIM, Axa IM, Manulife and other buy-siders tackled the toughest markets since 2008

Managing and mitigating operational risk in the Libor transition

In this webinar, industry experts discuss how, in the lead-up to 2021, firms are preparing for the operational implications of the Libor transition? They explore how their firms are adapting to alternative reference rates and mitigating the operational…

FX traders pull back to vanilla strategies for emerging markets

Spreads tighten on many currency pairs but liquidity still patchy

Deutsche Bank liquidity buffer shrinks €17bn

Clients’ clamour for cash forces bank to monetise liquidity pool

Bond managers relaxed ahead of bumper index rebalance

Fed’s credit facilities boost confidence as downgrades hit corporate bond indexes

Some quants fear more deleveraging to come

Buy-siders brace for further selling after hedge funds dumped risk in March

Bank of America shifts mortgage bonds into holding pen

By cutting available-for-sale assets, bank should avoid equity volatility

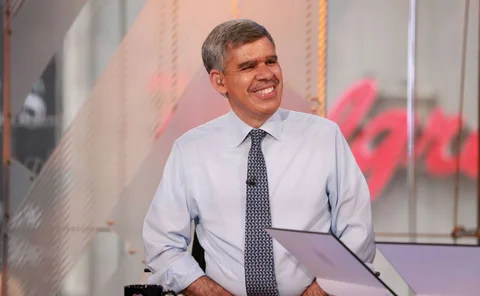

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Eurex seeks Hong Kong clearing licence

Bourse has Greater China in its sights after Japan and Singapore licences approved