Liquidity coverage ratio (LCR)

Bankers warn money market rates could hit Fed’s QT plans

Shrinking Fed bond portfolio could squeeze bank liquidity, though money funds remain flush

Don’t count on repo to monetise liquidity books, say experts

QT could force banks to sell bonds during stress, underlining need for fair value accounting

US banks reshaped liquidity buffers in Q2

Truist, BofA and US Bancorp lead highly liquid assets pile-up

NatWest’s LCR dips 4% as liquidity buffers shrink

Drop in net cash outflows contributes to lowest ratio since 2018

Big US banks boost cash holdings by nearly 8% in Q1

Dash for cash props up HQLAs as AFS securities drop to six-year low

Risk modellers navigate fearful new world of depositor behaviour

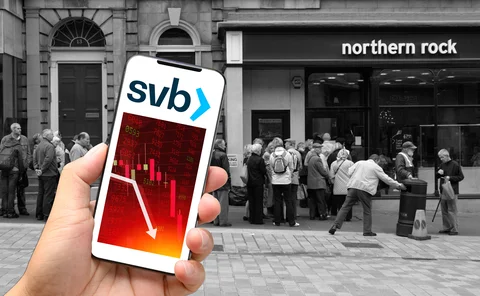

Silicon Valley Bank suffered fastest bank run in history, but how should others respond?

Bucking UK trend, StanChart’s LCR jumps in Q1

Sharp reduction in projected net cash outflows pushes liquidity ratio to highest point since 2017

FSB to examine social media role in bank runs

Isda AGM: upcoming report will trace flow of deposits out of failing banks; BoE warns of hidden leverage

SVB failure signals Fed’s need for a speed rethink

Rapid transition to large-bank bracket left supervisors flat footed on rate risk

Liquidity modellers clash on assuming central bank support

Experts disagree on whether internal stress tests should include emergency facilities

Doubts mount over BoE proposal to dilute bank liquidity rules

Before SVB collapse, UK suggested loosening NSFR reporting for smaller banks

Why tougher liquidity rules may not reduce the risk of bank runs

EU regulator and industry experts say LCR reform is the wrong response to Credit Suisse and SVB

Kneejerk regulatory reaction to SVB risks lending squeeze

Risk manager at regional bank says any Dodd-Frank 2.0 would be ‘fighting the last war’

The Catch-22 of US banks’ liquidity buffers

US banks are using held-to-maturity bonds to underpin liquidity adequacy, grating against accounting guidance. What happens if they’re forced to sell?

Deutsche Bank health check comes back clean

From capitalisation to derivatives, Germany’s top bank displays as robust a prudential profile as its peers

SVB opens floodgates on liquidity buffers debate

European regulator says HQLAs should be booked at fair value, but not everyone agrees

First Citizens closer to tighter rules after SVB deal

With assets more than doubling to $219bn, acquisitive bank flirts with category III designation

Before collapse, Credit Suisse projected lowest cash outflows since 2018

Customers were expected to withdraw just $91bn in a 30-day stress period despite heavy outflows going into 2023

SVB wouldn’t happen in Europe, says Deutsche CIB head

Campelli also thinks Credit Suisse’s bailed-in AT1 bonds acted as originally intended

Credit Suisse’s funding disclosures raise questions

The bank reported $141 billion of “other exposures” in NSFR at the end of 2022

US regional banks hold smaller proportion of high quality assets

Share of Level 1 assets at Capital One, Truist, US Bancorp lowest across US banks subject to LCR

At US banks, less than 50% of liquid assets classified as AFS

Goldman Sachs reported smallest proportion relative to HQLAs across US banks subject to LCR

Credit Suisse cuts exposures by 22% to match run on deposits

Bank dipped into central bank reserves and other safe assets to honour surge of withdrawals in Q4

Grim repo warning spotlights BNP Paribas booking model

Federal regulators may be targeting French bank’s Paris-based book of US Treasuries