Leveraged loans

SOFR swap basis could pose ‘systemic risk’

Trading curbs must be loosened to prevent tripling of unhedgeable basis risk, says senior banker

Credit checks, what credit checks? How crypto lending ate itself

Collapse of hedge fund Three Arrows Capital exposes “sloppy and irresponsible” credit standards among crypto lenders

RBC takes $296m hit on underwritten syndicated loans

The latest markdowns were higher than at the outbreak of the pandemic

Regional banks lead charge into term SOFR

Forward rate is favoured by smaller lenders and is increasingly used in caps and floors

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

Shadow US banks cool on riskier leveraged loans

Lowest-quality syndicated loans held by non-banks fall, though they remain well above pre-pandemic levels

Fillip for credit-sensitive rates as Axi, Critr advance

IHS Markit makes benchmarks available for live products; Invesco appointed as Axi administrator

Smaller US banks make case for credit-sensitive rates

BSBY and Ameribor emerge as preferred Libor successors for some regional lenders in multi-rate approach

Early movers get better pricing on SOFR loans

Borrowers making the jump to SOFR before year-end are being offered more favourable spread adjustments

Deutsche takes €17.7bn RWA add-on in final Trim hit

Leveraged loan portfolio among targets of ECB’s remedies

After bruising EU model review, banks ask: ‘Why bother?’

Post-Trim changes erode capital savings from internal models while raising their running costs

Model tweaks, asset cull helped Credit Suisse cut RWAs in Q3

Model updates took Sfr 2.5 billion off its credit RWA total

Eurozone securitisation dealmaking bounced back in Q2

Special purpose vehicles bought €19.2 billion of securitised bank loans in Q2

Covid recession makes US insurers’ junk bond piles riskier

About $227.5 billion of firms’ debt holdings are BB+ rated or lower

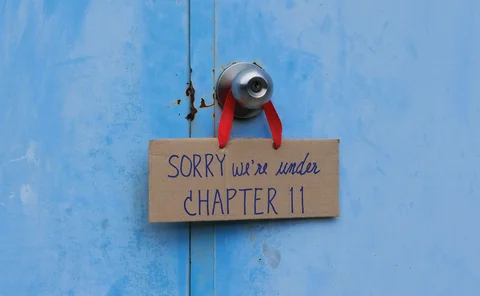

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

Covid shock could topple US insurers’ exotic CLOs

Losses on “atypical” tranches could hit $899 million

US insurers built up holdings of shaky bank loans in 2019

Non-investment grade loans make up 80% of insurer loan exposures

Japan Post marks down CLOs by ¥122bn

Lender has increased holdings of CLOs 76% since Q4 2018

Top insurers mark down CLO holdings following Covid-19 tumult

MetLife discloses $773 million unrealised loss

Asian investors primed to buy more CLOs, experts say

Liquidity and diversification are drivers for demand, after US loan market’s recovery from blip

Leveraged loan risks concentrated in handful of banks – FSB

US lenders make up 55% of exposures among global banks

UK banks could withstand leveraged loan crisis

Losses projected to hit overall CET1 capital ratios by 40 basis points

CLO stress test shows losses for US insurers could top $6.9bn

Under one stress scenario, BBB tranches could suffer losses

EU alternative funds hold €17bn of CLOs

Over 50% of AIF exposures concentrated in top 20 funds