Investment

Barclays, Deutsche, Credit Suisse take $437m hit on leveraged loans

Higher interest rates eroded value of facilities stuck in pre-syndication during Q3

BNY, State Street took $6.5bn fair-value hit to bonds in Q3

Eroding prices of RMBSs and govies keep widening unrealised losses

Asia moves: Senior hires at BNP Paribas, HSBC and more

Latest job news across the industry

Impact investing: trends and best practices

A panel of investment specialists discusses the rapidly expanding world of environment, social and governance (ESG) investing, with a particular focus on climate. They discuss best practice for achieving impact investing, their expectations on climate…

Derivatives house of the year, Japan: Credit Suisse

Asia Risk Awards 2022

House of the year, Indonesia: CIMB Niaga

Asia Risk Awards 2022

The rock-solid case for database marketing

With the right databases and intelligence, products can stand out above those of competitors

Allianz, Generali post €52bn in fair value losses in H1

Bond portfolio values crash as equities tailwinds fades

Multi-asset class portfolio stress‑testing: best practices and future challenges

Risk and investment professionals will require a sophisticated blend of historical and hypothetical scenarios to navigate today’s volatile markets, says Ivan Mitov, director of risk research at FactSet

Why database marketing is increasing in importance for asset managers

Improved market presence, product viewership and brand recognition, coupled with the ability to forge long-term community followings, is making the prioritisation of database marketing a no-brainer

Japan’s GPIF divests $1.5bn in Russia-linked assets

Pension fund cut exposure to country by 95% in the 12 months to March

Finding the investment management ‘one analytics view’

To meet their investment goals in today’s markets, chief investment officers (CIOs) and investment managers need a single view of risk and performance. So why is it so hard to achieve?

Bermuda ‘examined’ PE insurers criticised by US senator

Premier David Burt is ‘confident’ pension assets reinsured on the island are ‘appropriately’ regulated

CDS notionals made a comeback in 2021

A 5% rise to highest end-year figure since 2017 driven by swaps on junk debt

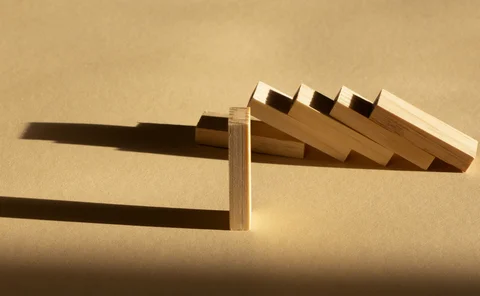

No soft landings in flight to safety from Russia

Impact of Ukraine invasion hit bank balance sheets hard; its effects look set to continue

US pension fund sues Credit Suisse over Archegos failures

Lawsuit alleges top execs breached fiduciary duties; Credit Suisse shareholders block board exoneration

Credit Suisse cuts leverage exposure by $11.5bn

CET1 leverage ratio remained flat over Q1 as drop in capital more than offset cuts in prime brokerage business

Single climate risk metric ‘not realistic’, says Bank of England

Senior official argues banks and investors must weigh up multiple factors when assessing climate risk

Hedging inflation may never have been trickier

Effective hedging depends on what’s causing prices to rise

The $1 trillion shortfall if private equity bets turn sour

Investors have to keep sending money to private equity firms even if returns crumble, says hedge fund executive

Firms question viability of UK consolidated tape model

UK government plan for a competitive framework for the consolidated tape raises concerns

Collateral resilience is more than just understanding initial margin

New regulations and extreme global events are seeing initial margin (IM) requirements rise in prominence, with investment managers needing to focus on more than just their regulatory and operational compliance

UniCredit ties buybacks to Russian exposure fallout

The Italian lender could lose as much as 200bp of CET1 ratio from a full write-down of Russian assets