Interest rate derivatives

Twin-track solution for ‘tough legacy’ Libor falls flat

Critics deplore lack of detail in UK taskforce's call for parallel legal fix and synthetic rate

Interest rate swaps powered Q1 derivatives boom at top US banks

Rate derivatives notionals increase 22% quarter-on-quarter

Switching CCP – How and why?

As uncertainty surrounding Brexit continues and the impacts of Covid-19-driven market volatility are analysed, it is essential for banks and their end-users to understand their clearing options, and how they can achieve greater capital and cross…

Ice swap rate adds safety net with Tradeweb quotes

Inclusion of dealer-to-client prices will boost publication rate in stress periods, IBA claims

Two-factor Black-Karasinski pricing kernel

Analytic formulas for bond prices and forward rates are derived by expanding existing rate models

LCH debuts central clearing for Sora derivatives

CCP expects surge in volumes after clearing first trade linked to Singapore’s risk-free rate

Markit plans SOFR credit spread add-on using CDS data

Vendor taps vast pool of credit market data to create new benchmark “not dissimilar” to Libor

Sonia proves its mettle through Covid-19 crisis

New risk-free rate gaining ground at Libor’s expense

Sonia term rate contenders tested by market mayhem

Regulator-proposed quote approach falters as dealers pull swap prices from screens

Short-dated sterling swap volumes surge

On April 22, traded volumes were four times the two-year average

Discounting delay risks swaptions mess – Eurex

Swaptions hurdles seen as yet another reason to keep June €STR switch date

After coronavirus rout, concerns raised about Simm

Annual recalibration means March volatility will not be reflected in margin until end-2021

ABN winds down Ronin books after Vix losses

$200m loss suffered by bank’s clearing business is thought to be mystery second default

Corporates sprint to lock in low rates

Dealers are seeing increased demand for interest rate hedges despite higher execution costs

OIS volumes collapse after rates plummet

USD OIS weekly traded notional falls to $502 billion from recent $3.3 trillion peak

Libor-SOFR blowout raises questions for fallback rate

Implied three-month SOFR v Libor basis gapped to 108bp on March 19

Swaps benchmark vanishes as traders flee firm price venues

Dollar Ice swap rate fails to publish in March rout; patchy Sonia Clob prices could delay term rates

Swaps liquidity slumps as Treasury stress spreads

Big buy-side participants report “worst day” for market depth in 10 years, as spreads widen and prices gap

Bonds and swaps struggled in virus volatility

Low liquidity and wider spreads amplified by remote working, traders claim

Sonia swaps surge not mirrored by futures

Popularity of short sterling futures takes shine off Sonia’s RFR succession

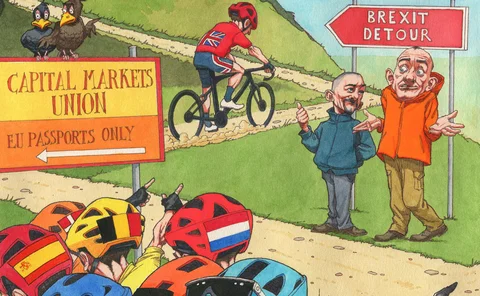

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

At US G-Sibs, rates derivatives notionals the lowest since 2014

Banks cut interest rate swaps notionals by -18% year-on-year

Dollar OIS volumes hit $3.3trn high

Short-dated swaps dominated trading in last week of February

FCA: sign up to fallback protocol or face ‘serious questions’

UK regulator urges derivatives users to accept Isda swap fallbacks to ensure compliance with benchmark law