Hedging

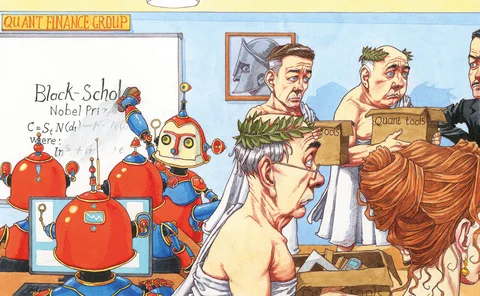

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Forex ‘last look’: how non-banks stack up

Research shows patchy disclosures, plus differences from banks on pre-hedging and rejected orders

Basis swaps spike amid US rates chatter

Budgetary wrangling and talk of Fed cuts spark Libor-OIS basis shift

Ford reaps derivatives gains following interest rates dip

Swap assets of automaker’s financial services unit hit $1.2 billion

One size does not fit all – Adapting to meet investment goals

Guillaume Arnaud, global head of quantitative investment strategies (QIS), and Sandrine Ungari, head of cross-asset quantitative research at Societe Generale, explore the benefits of QIS for investors, why flexibility is crucial for investors to meet…

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

UBS unleashes Orca for rates clients

Machine learning algo trawls liquidity pools to slash US Treasury trading costs

Podcast: Hans Buehler on deep hedging and harnessing data

Quant says a new machine learning technique could change the way banks hedge derivatives

Japan regulation sparks hunt for new annuity products

Foreign currency products hit by push for transparency on forex risk and charges

JP Morgan turns to machine learning for options hedging

New models sidestep Black-Scholes and could slash hedging costs for some derivatives by up to 80%

China Minsheng and SocGen team up for quant index product

CMBC Macro 1 signal index attracts $580 million as investors adapt to products without performance guarantees

Energy Risk Awards 2019: The winners

BP and Engie pick up two awards each, while BNPP takes the coveted derivatives house of the year

CFTC's Berkovitz puts his weight behind position limits

New rule on speculative commodity trades will be proposed within weeks

Korea tightens autocall oversight as local houses take on risk

Regulator sounds warning over $9 billion increase in structured product self-hedging by Korean firms

Natixis's VAR returns to earth after sale of autocallables

Average value-at-risk falls 35% from Q4 2018 high

Remembering the range accrual bloodbath

Flatter US yield curve spurs demand for a product with a painful history

MetLife executes $250 million SOFR-linked repo

Isda AGM: US insurer's hedging chief says systems issues hindering its use of derivatives, however

Risk FX Briefing: Event insights

What lies ahead for investment managers

Risky notes replace easy money for exotics desks

Dealers insist ‘it’s different’ as flat US curve revives bonds that sank the Street in 2008

FSB says fallbacks should kick in if Libor no longer accurate

Isda plans to consult on what to do if a benchmark is no longer representative of underlying markets

As China bonds go global, dealers size up demand for swaps

China’s onshore derivatives market must grow quickly to meet the hedging needs of foreign investors