Hedge funds

Bank credit risk: how well do you know your counterparties?

As financial markets evolve, evaluating the complex credit risk exposures of non-bank counterparties is crucial for effective risk management, says Quantifi’s Dmitry Pugachevsky

Foreign buyers jolt e-trading in Japan government bonds

Platforms report rise in small-ticket volumes, but bigger trades remain on voice

Traders eye negative CDS-bond basis

Changed market dynamic can be profitable for those firms able to capture it

Driving a modern operational resilience program

Strengthen your operational resilience processes, meet pertinent regulatory requirements in this space and enhance business continuity practices with the help of high-performance GRC technology

Euro area funds’ debt securities surged 13% in 2023

Investments vis-a-vis euro area issuers rebound after 2022 slump, driven by bond funds

Inside BGC’s quiet move into agency broking

The interdealer broker’s Caventor Capital arm is pitching a hands-on service for hedge funds, filling what it sees as a gap left by large banks

How China’s equities intervention caused a quant fund quake

Popular leveraged market-neutral trade crumbled after government stepped in to support major indexes in February

Fed unveils hyper-Archegos test to reveal bank blow-up risks

CCAR for 2024 includes analysis of simultaneous defaults of five largest hedge fund clients

Trend following struggles to return to vogue

Macro outlook for trend appears to be favourable, but 2023’s performance flop gives would-be investors pause for thought

CVA swap: a new type of capital relief trade

Dmitry Pugachevsky, Quantifi, discusses the emergence of the CVA swaps market

Hedge funds push for transparency in credit determinations

Proposals include more disclosure around meetings and detailed rulings of credit events

Undeterred, hedge funds bet on euro swap steepeners

Expected rate cuts and pension reforms are driving steepener flows, but large pension funds may not be finished hedging at the long end

Investment management ‘one analytics view’ for credit bonds and ESG risk factors

A Chartis and MSCI research report that examines how firms must integrate ESG risk analytics with multiple other performance or risk analytics in credit bond portfolios to obtain a meaningful, quantitative and comprehensive investment view

How AI can give banks an edge in bond trading

Machine learning expert Terry Benzschawel explains that bots are available to help dealers manage inventory and model markets

Rustad re-emerges at Taula Capital

Former JP Morgan clearing head to help prepare for Q2 fund launch

Review of 2023: a hard road to a soft landing

Banks and regulators were caught in the crosswinds of the fight against inflation

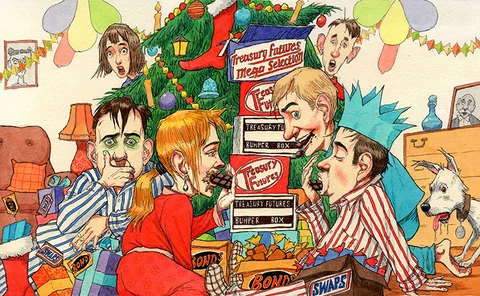

The unknown risk on the flip side of the basis trade

US mutual funds have amassed record notionals in Treasury futures that in some cases exceed their AUM

Hedge funds rev up short-vol trade in zero-day options

Firms are capping exposures to avoid a rerun of 2018’s ‘Volmageddon’ unwind

AI model uses quantum maths to learn like a human

Could the next big breakthrough in machine learning come from the world of finance?

Margin failings raise concern over Treasury basis trade

Opaque models at clearing houses cast doubt on calculations for concentration add-on

FX HedgePool launches all-to-all FX swaps matching

P2P platform starts daily matching and opens up to banks, hedge funds and ECNs

PTFs loaded up on US Treasuries during SVB collapse

Treasury official says non-bank interdealer market share rose 10 percentage points in March as dealers retreated

SEC to delay US Treasury clearing mandate, dealer rule

A final vote on proposed US Treasury market reforms is now expected in early 2024

Safeguarding the future: ensuring cyber security in hedge funds

This paper explores the increasingly complex cybersecurity threats facing hedge funds and asset managers, including real-life case study examples, and reveals why a multi-faceted cybersecurity approach is needed to keep pace with emerging risks.