Government bonds

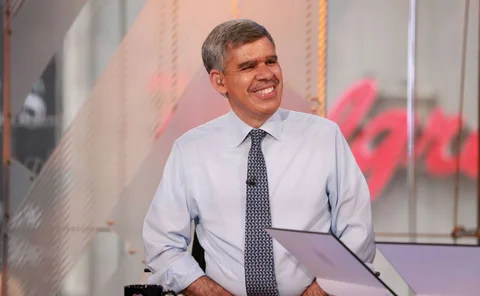

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Banks fear time-limit on Fed leverage ratio reprieve

Capital constraints not covered by relief also weigh on balance sheet strategy

Fed’s leverage ratio relief puts foreign banks on the back foot

European banks cannot – yet – exempt US Treasuries from their exposure measures

Deutsche Bank cut liquidity buffer in 2019

Cash balance dropped €49 billion last year

Bankers say discount window is imperfect fix for UST woes

Further changes advocated to ensure Treasuries are used in US bank liquidity buffers

US Treasury market holds its breath after high drama

Intermediation broke down after off-the-run bonds were dumped on banks

Equity, Treasury collateral builds up at US G-Sibs

Fair value of equity collateral rises 19% year-on-year

Systemic US banks’ trading portfolios swell 10% in 2019

US Treasuries held-for-trading soar 28% on Q4 2018

EU funds loaded up on US debt in 2019

Net purchases of US debt up +962% in 2019

On eve of Brexit, PPF’s chief risk officer isn’t too worried

Stephen Wilcox talks about getting pensions paid without the benefit of controlling ‘UK Plc’

Own-country risk makes up 42% of EU bank sovereign exposures

Polish, Estonian and Romanian banks most exposed to home governments

Squeezed or saved? Market divided over year-end repo stress

Fears of a cash-crunch hang heavy despite Fed’s repo giveaway and move to term funding

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

Rates flow market-maker of the year: Citadel Securities

Risk Awards 2020: US Treasuries business in Europe stoked by credit rating addition

Low investment grade debt a staple of EU insurer portfolios

Debt holdings just one notch above junk status make up €642.8 billion of standard formula insurer assets

At bounding MarketAxess platform, a new CRO parses risk

Clarity and communication are basics to Oliver Huggins at one of the biggest US bond platforms

EU banks pare own-country sovereign exposures

Banks held €1.76 trillion of domestic government bonds in Q2 2019, down from €1.91 trillion a year ago

SEC mulls extra scrutiny of US Treasuries trading venues

Roisman suggests US might apply full rigour of Reg ATS to non-exchange Treasuries platforms

Insurers slow purchases of eurozone sovereign bonds

Annualised growth rate of government debt holdings falls to 2%

Liquidity coverage at US G-Sibs worsens in Q2

HQLA rose $18bn while projected net cash outflows jumped $29bn

Generali pivots from corporate bonds

Company debt makes up 31.6% of life insurance investment portfolio; 28.1% of property and casualty portfolio

Sovereign spreads and Target2 anomalies

Widening risk imbalances between eurozone member states threaten monetary union, says Italian regulator

UBS unleashes Orca for rates clients

Machine learning algo trawls liquidity pools to slash US Treasury trading costs

At systemic US banks, HQLA falls $35bn in Q1

LCRs drop at JP Morgan, Citi and BofA Securities