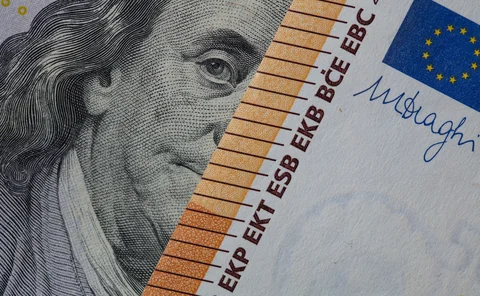

Foreign exchange

Corporates pressed on FX hedges as dollar surge bites

CFOs increasingly facing tough questions about impact of exchange rates on foreign revenues

Funds tap options on FX vol amid tariff disruptions

Dealers say vanillas, digitals and knockouts on realised vol increasingly used to navigate Trump news flow

During Trump turbulence, value-at-risk may go pop

Trading risk models have been trained in quiet markets, and volatility is now looming

Corporates eye complex FX hedges as carry costs mount

Leveraged forwards and options-based structures entice treasurers facing rates uncertainty and FX volatility

Trump’s tariff threats fuel corporate FX hedging revamp

Treasurers mull options and longer-dated hedges in face of mixed signals on extent and timing of measures

Iosco pre-hedging review: more RFQs than answers

Latest proposals leave observers weighing new clampdown on pre-hedging

Isda to finalise drafting updated FX definitions this year

New definitions on disruption events and fallbacks are core focus

Does no-hedge strategy stack up for mag seven mavericks?

At Amazon, Meta and Tesla, the lack of FX hedging might raise eyebrows, but isn’t necessarily a losing technique

South Korea’s FX reforms working amid political crisis, dealers say

Martial law presented first test for reforms aimed at boosting deliverable KRW market

BNY hires Deutsche Bank’s Wu to revamp e-trading

New York-based bank is combining e-FX spot, e-FX forwards trading and strats group

Amazon, Meta and Tesla reject FX hedging

Risk.net study shows tech giants don’t hedge day-to-day exposures

Iosco mimics industry codes to tackle pre-hedging dilemma

Advocates breathe sigh of relief, but Iosco release carries suggested restrictions

Franklin Templeton dethrones MSIM as top FX options user

Counterparty Radar: MSIM continued to cut RMB positions in Q3, while Franklin Templeton increased G10 trades

The path to operational resilience begins with reliability and risk management

The challenges Apac financial services firms face enhancing operational resilience and leveraging data and hybrid cloud

FX automation key to post-T+1 success, say custodians

Custody banks saw uptick in demand for automated FX execution to tackle T+1 challenges

OTC derivatives hit $730 trillion peak in H1 2024

Interest rate and FX derivatives drive notional spike

Doubts raised over new FX platform disclosures

New disclosure sheet template will require platforms to outline how they charge for data

Pimco and Vanguard slash FX forwards trading with BNP Paribas

Counterparty Radar: French bank sees its notional with mutual funds halve

Profit and pain as macro turmoil engulfs Brazil

FX options trades pay off, while sharp jump in rates caught traders by surprise

Repo and FX markets buck year-end crunch fears

Price spike concerns ease as September’s surprise SOFR jump led to early preparations for bank window dressing

Cross-currency futures could ease bilateral burden – CME

Quarterly €STR-vs-SOFR contract could be used by Stir desks to manage currency basis risk

‘It’s not EU’: Do government bond spreads spell eurozone break-up?

Divergence between EGB yields is in the EU’s make-up; only a shared risk architecture can reunite them

Consortium-backed FMX eyes push for FX unit

Formerly Fenics FX, the venue has seen growth from dealers and non-banks using its pegged order types and dark pool liquidity

Bilateral streaming relationships set to grow, say LPs

FX Markets Europe: More clients are embracing APIs to access bank liquidity directly