Foreign exchange

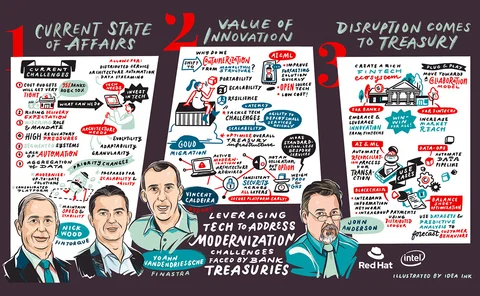

Leveraging technology to address modernisation challenges faced by bank treasuries

Bank treasurers and technologists convened for a Risk.net webinar in association with Red Hat to consider how technological innovation could help treasury functions meet rising expectations

Managing financial risk in cross-border emerging markets M&A

BNP Paribas’ Djamel Bruimaud, strategic sales lead for foreign exchange and local markets for European corporates, and Stephane Benhamou, head of forex and rates solutions sales, France, discuss the creation and execution of a hedging solution designed…

Ion forced to ditch Broadway rates business

Remedy satisfies UK competition watchdog – but “a big defeat” for acquisitive tech giant

FX swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

FX swaps clearing redux

SA-CCR could unleash the potential of clearing, and may ignite some big changes

SA-CCR adoption may spur wider FX swaps clearing

With up to 90% lower exposures on offer, dealers say capital benefits could outweigh margin costs

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

UK watchdog has competition concerns over Ion-Broadway deal

Trading tech giant has five days to address issues, or face months-long investigation

Bargain-hunting equity hedgers turn to FX

Currency options are cheap relative to stock index puts, but correlations are uncertain

RMB hedging comes onshore as regulators liberalise FX market

Foreign investors turn to CNY for bond hedges as rule changes spur more competition

Jittery ringgit spurs options growth in Malaysia

Local corporates seek new hedging tools, but longer-term options liquidity lacking

Banks tout early roll dates for FX swaps as quarter-end looms

Asset managers open to more flexible hedging strategies since March turbulence, say dealers

Appetite for renewed Fed dollar swap lines in doubt

With up to $300bn of positions nearing expiry, some say FX swap market can meet banks’ funding needs

FX traders sound alarm on tagging ‘abuse’

Front running and tag refreshing concerns abound on semi-anonymous trading platforms

Turkey turmoil opens door to offshore NDF market

Emta invites input on documentation for offshore lira

Choppy markets revive quest for RFQ’s ‘magic number’

Deutsche argues for smaller, stronger panels; Citi offers better prices for 'full amount' trades

Andreas König’s crisis playbook meets Covid-19

Interview: Trading from home may be odd, but Amundi’s FX head was ready for other stresses

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

Investors trade the drama out of the crisis

How LGIM, Axa IM, Manulife and other buy-siders tackled the toughest markets since 2008

Spot FX shies away from regulatory yoke

As Europe weighs Aussie-style rules for spot trading, some see benefits – but many fear the burden

Volatile FX markets reveal pitfalls of RFQ

Clients urged to mask trading intent; critics warn of subtle sell-side advantages

FX traders pull back to vanilla strategies for emerging markets

Spreads tighten on many currency pairs but liquidity still patchy

NDF access will help tame rupee volatility, say dealers

Lifting of restrictions stopping Indian banks trading rupee NDFs allows RBI to intervene offshore

Ion’s wrists slapped in probe of Broadway deal

Competition watchdog extends initial investigation after Ion failed to comply with call for info