Fixed income

US Treasury market holds its breath after high drama

Intermediation broke down after off-the-run bonds were dumped on banks

Swaps liquidity slumps as Treasury stress spreads

Big buy-side participants report “worst day” for market depth in 10 years, as spreads widen and prices gap

Rates trading revenues up 154% at top US banks

Net gains on interest rates-related exposures top $21 billion

Top banks’ US Treasury holdings up 26% in 2019

Fair value gains follow plummeting yields on government paper

Ion’s Broadway deal leaves banks in a bind

Barclays and Nomura among banks that had moved from Ion to rival it now controls

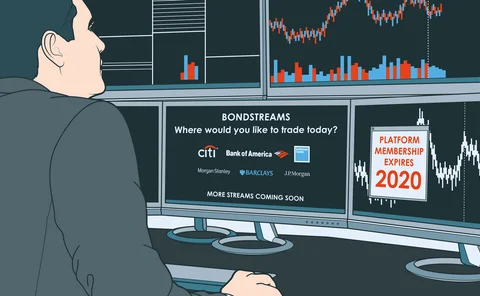

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Bank disruptors: how tech joint ventures help Nomura’s bottom line

Nomura is developing new software services to supplement trading profits

Haitong taps NLP to inform collateral coverage

Hong Kong broker scours news and blogs in bid for better corporate signals in China’s opaque markets

Eurex: from EQD clearing specialist to all-rounder

Initial margin for equity derivatives makes up 41% of total, down from 63% four years prior

Bank risk manager of the year: HSBC

Risk Awards 2020: New market risk system proves its worth in a year of emerging market blow-ups

OTC trading platform of the year: Tradeweb

Risk Awards 2020: To keep volumes growing, platform had to confront “incumbent’s dilemma”

Banks team up for ‘Ion replacement’ project

Consortium weighs building fixed income software in potential threat to Ion, the dominant vendor

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

Plumbing problems in the repo market

On September 17, three banks may have sucked up nearly a quarter of money market fund cash

BlackRock, State Street, AB are making AI work in risk

Risk USA: Fund managers are using new technology to measure liquidity risk and spot their own errors

Asia moves: HSBC hires Singapore liquidity chief, StanChart picks Asean head, and more

Latest job changes across industry

Interest rate, credit risk push BNP Paribas’ VAR up 25%

French bank also reported a VAR breach in Q3

Best CVA practices in Japan

At a recent roundtable in Tokyo, banks and regulators discussed progress on credit valuation adjustment (CVA). While, in many respects, the work towards implementing best practices in the country is on track, challenges remain in resourcing and…

Companies delay climate policy action at their peril

Failure to take immediate action on the proposals set out in the Paris Agreement on climate change could cost approximately $1.2 trillion over the next 15 years in policy risk costs. Oliver Marchand, co-founder of Carbon Delta and executive director of…

Europe eyes the pitfalls of Japanification

Does the cultural and demographic experience of Japan apply to a heterogeneous grouping of nations that have no common monetary policy or a unified social outlook?

Fixed income portfolio trading sees rapid take-up

Tighter spreads and ease of execution spur European firms to trade baskets of bonds

Poor data hurting buy side’s automated bond trading

Spotty bond liquidity creates gaps in trading data that could harm best execution, insiders warn

ETF strategies to manage market volatility

Money managers and institutional investors are re-evaluating investment strategies in the face of rapidly shifting market conditions. Consequently, selective genres of exchange-traded funds (ETFs) are seeing robust growth in assets. Hong Kong Exchanges…