Financial stability

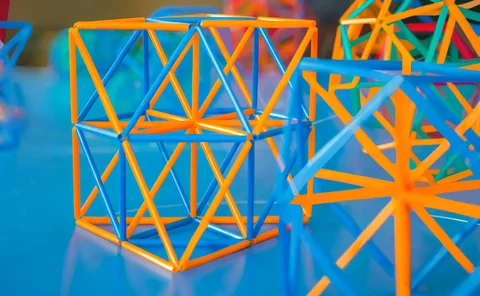

Default cascades and systemic risk on different interbank network topologies

This paper examines the relationship between the topology of interbank networks and their ability to propagate localized, idiosyncratic shocks across the banking sector via banks’ interbank claims on one another.

Ties between EU insurers and banks vary by country

Estonian, Cypriot and Swedish insurers most exposed to banking sector

China hints at future bank resolution framework

Baoshang Bank collapse offers clues to how government intends to resolve tomorrow’s failing banks

Eurozone insurers’ bets on alternatives raises systemic risk

Dutch firms have more than 25% of total assets tied up in non-traditional investments

No more delays on Mifid open access, EU regulator says

European authority confirms July 2020 start date, reigniting argument over market stability versus competition

Realism or deregulation? Fed sidelined in oversight of insurers

Proposed activities-based approach to non-bank systemic risk will make Sifi designations less likely

Q&A: Japan regulator aims to be glue for fragmented rules

“Unintended and unnecessary” splits in regulation damage financial markets, says FSA’s Ryozo Himino

Study floats idea of breaking up CCP services

Proposal includes explicit public backstop for key functions and private provision of other services

Buy-siders eye ways to get ahead of US resolution stay rules

Come July 1, asset managers will be unable to dump derivatives as a G-Sib is unwound. Lawyers are standing by

Small banks in China carry outsized risk – research

Study shows systemic risk of smaller banks snowballs during stress periods

Basel haircut floors threaten securities financing desks

Banks fear capital hit unless regulators provide exemption for stock borrowing

Driverless insurance: regulating Prudential without the Fed

Scrutiny on largest US insurer should not be laxer than on second-tier US banks, experts warn

EU seeks US-style freedom to delay rules

Power to grant “no-action relief” appears in proposals from EU Council and Parliament

A three-state early warning system for the European Union

In this paper, the authors develop an early warning system for forecasting a financial crisis of the magnitude of the 2007–8 crisis for the European Union (the EU14).

FDIC may rethink Camels scoring for smaller banks, says chair

Community banks want end to public shaming of those who fail key supervisory test

UK bank funding costs spike in Q1 – BoE

Total term debt issuance is around 60% higher this year to date than at the same points in 2016 and 2017

G-Sib swap portfolios reveal transatlantic divide

EU banks record 16% fall in non-cleared swaps, while US dealers see 9% growth

Trade data initiatives aim to unify regulatory reporting

Standardised data would improve systemic risk monitoring and save firms billions, say data engineers

Custody surge could be precursor to capital pain

BNY and State Street assets hit new record, as Basel consider G-Sib changes

Regulatory merger keeps China on course for deleveraging

Combination of banking and insurance regulators offers opportunity to co-ordinate debt reduction measures

Central counterparty resolution: an unresolved problem

This paper describes the current policy for recovery and resolution of CCPs and assesses the tool kit for resolution of them.

Fed’s Powell: Libor death is ‘big stability risk’

Speaking to Risk.net, Fed chair nominee flags Libor dangers for FRNs, loans and other products

US Treasury’s research arm revamps systemic risk models

New approach from OFR relies on separate measures of stress and vulnerability