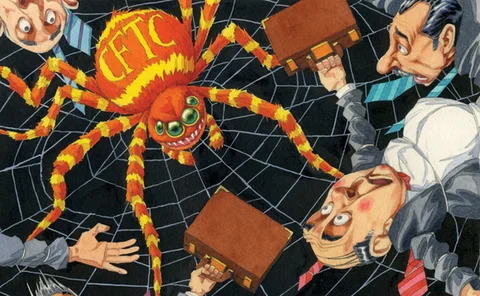

Extraterritoriality

SEC cross-border rules an improvement on CFTC proposals, say lawyers

Narrower US person definition and substituted compliance proposal win praise from market participants

Think locally, act locally: Anger over US plans for foreign banks

The Federal Reserve is planning a radical departure from traditional supervision by requiring the local offshoots of foreign banks to meet US capital and liquidity rules. Overseas banks are furious – and regulators are backing them publicly, amid fears…

New Iosco chair launches cross-border taskforce

Greg Medcraft took over as chair of the International Organization of Securities Commissions in March, alongside his role as chairman of the Australian Securities and Investments Commission. He talks to Luke Clancy about his priorities for both roles

Isda AGM: Closer international co-ordination needed, says MAS’s Ng

The potential for conflicting regulations could hamper cross-border trades, warns MAS official

US warns EU over financial transaction tax

The US will not allow the EU financial transaction tax to happen, according to the head of US Chamber of Commerce Thomas Donohue. Co-ordination between G-20 countries on financial regulation is needed

Q&A: Sylvie Matherat on extraterritoriality and central clearing

Europe and the US are at loggerheads over the territorial scope of new derivatives rules – as evidenced by a new financial stability review from the Banque de France – but agreement can be reached, says Sylvie Matherat, the central bank’s deputy director…

Finance ministers warn US on extraterritoriality

Letter to US Treasury secretary says OTC rules should be applied within national borders only. Signatories include French, German, UK finance ministers

CFTC should extend US persons fix, says O'Malia

Agency has not begun debating final definition of US person and "will need to provide relief" when temporary exemption expires, says CFTC commissioner

Broader US person definition could cause clearing avalanche, participants warn

A large number of offshore funds could be classified as US persons once a CFTC exemption expires in July, subjecting them to Dodd-Frank transaction-level rules

RBS Libor fine confirms CFTC intent to police global markets

Hedge funds around the world need to take note of the recent fine imposed on Royal Bank of Scotland and the extraterritorial reach of the the US Commodity Futures Trading Commission.

Lack of clarity over clearing provides problems for Asia banks

The deadline set by the G-20 to clear all standardised OTC derivatives has passed but a lack of regulatory clarity over the shape of reform is hampering banks in the region

Risk USA: Cross-border conflicts could leave firms unable to comply

Hedge fund CQS warns US persons definition will make compliance more difficult - or even impossible

CFTC rules could force European funds to break the law

Breaking the rules

Section 716: The do-nothing approach

The do-nothing approach

Fingerprint, aggregation fears hit swap dealer countdown

Prints and be damned

Errors in CFTC extraterritorial guidance to be amended

A CFTC source acknowledges that inconsistencies in the proposed interpretative guidance on the cross-border application of Dodd-Frank will have to be ironed out

Risk 25 firms of the future: CFTC

The costs and benefits of reform

OpRisk Europe 2012: Video

Highlights of the keynote speeches and discussions from this year's London conference

CFTC relaxes cross-border rules after commissioner backlash

Chairman Gensler is understood to have relented on ‘substituted compliance’ in order to pass the proposed guidance

Extraterritoriality remains a major issue, says FSA’s Lawton

Resolving issues around the extraterritorial application of derivatives regulation is a major outstanding issue that needs to be addressed, says FSA’s acting director of markets