Exchanges

Dividend delays upend pricing of Eurostoxx futures, options

Investors that rolled futures contracts before companies axed AGMs “could have lost a lot of money”

Equivalence failure threatens European share trading

UK and EU investors may be forced to trade dozens of shares on less liquid exchanges, analysis shows

Exchange shutdowns could trigger derivatives unwinds

Eight-day closure would invoke subjective valuation clauses; hedge disruption could cancel trades

India exchange to debut rupee derivatives settled in US dollar

Launch of onshore futures and options unlikely to dent offshore volumes, though

Apac CCPs: we’ve come a long, long way together

Members still gripe about arcane policies, but risk management fundamentals are strong

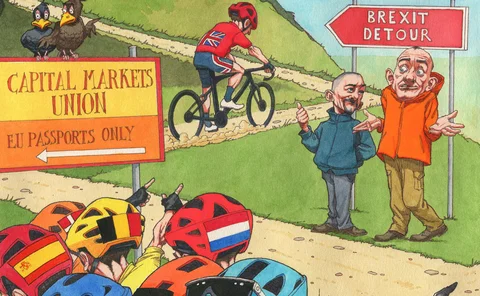

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

EU snubs plan to delay CCP open access rules, for now

Attempt to squeeze delay into crowdfunding rules fails, but Mifid review provides last chance

Leaked email reveals new assault on CCP open access rules

Largest group in European Parliament wants to shoehorn delay into crowdfunding legislation

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency

How pre-trade IM calculation can optimise and reduce collateral drag

With firms under pressure to make their systems compliant with uncleared margin rules (UMR), the increase in margin requirements has put further strain on the availability of high-quality liquid assets. Mohit Gupta, senior product specialist at Cassini…

Rate options and futures volumes plummet $10trn in Q3

Open interest in short-term options collapses 10% quarter on quarter

Death, taxes and technology risk

Exchanges must plan for the certainty that their technology will fail, sometimes

CCP defaults, Pillar 2 charges and robo-raters

The week on Risk.net, November 9–15, 2019

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

Search for alpha in a volatile world

Alpha generation can be an elusive goal, particularly when trading volatility. Three different approaches to trading volatility were discussed by a panel looking at the role of systematic and carry strategies in finding profit in a high-volatility world

ETF strategies to manage market volatility

Money managers and institutional investors are re-evaluating investment strategies in the face of rapidly shifting market conditions. Consequently, selective genres of exchange-traded funds (ETFs) are seeing robust growth in assets. Hong Kong Exchanges…

ESG investing: It’s not just great to be good

Investing according to environmental, social and governance (ESG) criteria can be done in various ways, with continuing development of filters and ways of analysing companies. As the market in ESG indexes and investments linked to sustainability matures,…

Short-term interest rate ETD notionals leap $14trn in Q2

Open interest in exchange-traded options with maturities of a year or less rise 19%

Asia’s ETF assets on the rise – HKEX presents the results of Asia ETF survey 2019

Asia’s total ETF assets surged by 23.9% in the first half of 2019 thanks to an increasing adoption of ETFs into investment portfolios. According to a survey conducted by Hong Kong Exchanges and Clearing (HKEX), asset expansion in Asia’s ETF market is set…

Euribor futures spread spike strangles prop traders

Safe-haven butterfly trades savaged by shock divergence in mid-term contracts

CurveGlobal and the curious case of the lost open interest

One-third short sterling plunge in open interest on CurveGlobal may signal more capital-sensitive times