Eurozone

FX Week China: CNH/CNY forward divergence threat has stabilised

A reversal of the spread between offshore deliverable forwards and onshore NDFs that caused pain for speculators last year is unlikely to recur, say economists

Spanish banks allowed to ignore default risk for sovereign bonds

Banco de España is one of a number of European supervisors allowing its banks to ignore a Basel 2.5 requirement to model default risk on government bonds

Eurozone scenarios: political analysts give their views

Unknown quantities

Greek exit threatens eurozone ALM

The Greek gift

Eurozone risk management gets political

Getting political

Risk institutional investor rankings 2012

Deutsche on top

Wealthy Greeks turn to offshore securities to escape redenomination risk

The massive drop in deposits held in domestic banks in Greece is partly attributable to transfers of savings into overseas accounts or securities to mitigate fears of a Greek eurozone exit and a return to the drachma

Eurozone crisis to have limited impact on southeast Asia – Asean Risk 2012

Resilience in regional markets will insulate Asian nations from any European slowdown, say economists during Asean Risk 2012 roundtable

Deposit flight threatens banks' eurozone ALM efforts

Attempts to match assets and liabilities on a country-by-country basis could be threatened if Greece exits eurozone, lenders fear

Power and utilities M&A declines in volume but grows in value: Ernst & Young

Slow global economic recovery led to weak M&A activity in the global power and utilities sector in the first quarter of 2012, but deal value increased almost 20% from the previous quarter

People profile: Patrick Colle, BNP Paribas Securities Services

Global ambition

Sponsored statement: Vanguard

The certainty of uncertainty: When not to jump

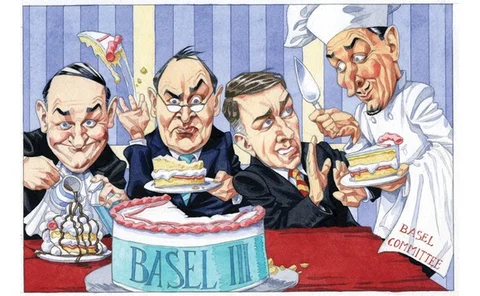

Different preferences create divided implementation of Basel III

A matter of taste

Europe's inflation investors sharpen their focus

Europe's inflation investors sharpen their focus

Risk Espana rankings 2012

Light at the end of the tunnel

Renewable energy projects seek investment alternatives

Funding alternatives

Risk awards video: What are the biggest challenges for 2012?

New regulation and the ongoing sovereign debt crisis in the eurozone are named as the key challenges for 2012 by the winners of this year’s Risk awards

Stronger defences needed: stress testing a eurozone break-up

For a few dollars more

Mining companies remain unhedged, despite Chinese clouds

The hedge of reason

Corporate backlash on costs of regulation continues

Banks will not be able to avoid passing on the hefty costs of regulatory reform to their buy-side clients, argued participants at the ACI UK’s annual square mile debate

Eurozone scenario analysis goes microscopic

Familiarity breeds content

Dealers tackle euro redenomination risks

Back to the drachma?

New Prime Finance panel could tackle debt crisis disputes

An arbitration panel set up to tackle derivatives disputes could also tackle eurozone debt crisis issues, says Jeffrey Golden, architect of the Isda master agreement

No nosedive: markets could defy doom-mongers

Challenging the doom-mongers