Emir

What will clearing cost?

What will clearing cost?

Energy firms gear up for new data management requirements

Dealing with a data flood

Regulation to hit bank profitability - Risk survey

Dealers expect new rules to hit the profitability of their business, but fewer expect to be able to pass the costs along – and more are anticipating a big drop in OTC trading volumes

Industry slams 'unworkable' Esma proposals on indirect clearing

Clearing members would be forced to guarantee trades executed by their clients' clients - on terms the member firms have not agreed

Pressure mounts on Esma over clearing exemption

Responses to Esma's draft technical standard on Emir call for the agency to clarify its position on forex clearing - with some suggestion NDFs could be exempt

Risk 25 firms of the future: GFI Group

Exchange ambitions

Risk 25 firms of the future: Tradeweb

RFQ supporter hedges its bets

Corporate statement: energycredit

Are your systems ready for the next generation of energy regulations?

Esma: making time for ETFs

The July 2012 issue of ETF Risk covers regulation, liquidity risk and tracking error

Extraterritoriality remains a major issue, says FSA’s Lawton

Resolving issues around the extraterritorial application of derivatives regulation is a major outstanding issue that needs to be addressed, says FSA’s acting director of markets

Securitisation market seeks SPV clearing carve-out

Securitisation would be "a lot less viable" if SPVs do not qualify for clearing exemption, says Isda

The last word: Collateral and CCPs

The leading question

No improvement in porting since Lehman, CCPs say

The collapse of MF Global last year saw clearing houses struggle to port client collateral to other firms - repeating problems seen after Lehman Brothers filed for bankruptcy in 2008

UBS: Sef aggregation 1.0

Pin money

Isda AGM: ‘Life as we know it will change,’ says O’Connor

New regulations will help reduce systemic risk, but changes need to be made to certain parts of the rules, Isda chairman says

Isda 27th Annual General Meeting Chicago 2012

End in sight?

Managing the regulatory patchwork to ensure global consistency

Managing the regulatory patchwork

A turning tide for two-way CSAs?

A turning tide for two-way CSAs?

Cross-border confusion between domestic clearing houses

Cross-border confusion

Tentative on G-20 timelines for OTC derivatives clearing

Tentative on G-20 timelines

To clear or not to clear? Corporates urged to weigh options

Despite hard-won exemptions, corporates should consider the pros and cons of clearing, according to panellists at an ACT event - but treasurers remain unconvinced

Regulators look out for clearing dodges

Out of the clear?

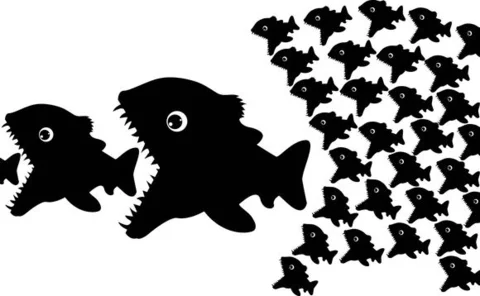

Each: CCPs seek safety in numbers

Each and everyone