Equity options

SA-CCR tweak could slash equity risk charge – research

Better calibration would cut equity options exposures in half, research finds

Asia’s private wealth giants shift gears to market-neutral

With interest rates low, structured product investors bypass capital-protected products for market-neutral strategies

Credit Suisse bets on intraday vol signals to revive FIA sales

New line of fixed indexed annuities will use intraday data for more precise vol targeting

Credit exposure under the new standardized approach for counterparty credit risk: fixing the treatment of equity options

The new standardized approach for measuring counterparty credit risk exposures (SA-CCR) will replace the existing regulatory standard methods for exposure quantification. This paper provides empirical evidence that the SA-CCR parameters are not aligned…

Autocalamity: can hit product be reinvented?

Spreads on ‘worst-of’ bonds leap 50% as some dealers retreat and others pile on hedges

BofA becomes first US bank to adopt SA-CCR

Move cut leverage exposure by $66bn, but other banks wary of trade-offs

A new arbitrage-free parametric volatility surface

A new arbitrage-free volatility surface with closed-form valuation and local volatility is introduced

EU banks expect further margin reprieve for equity options

Exemptions for intra-group and equity options from non-cleared margin rules expire by January 2021

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

EU gives one-year margin reprieve on equity options

Regulators point to possible systemic risk in margin loophole, as industry urges parity with US

IM phase five – Smaller on bang, bigger on complexity

The initial margin ‘big bang’ may have been reined in by last-minute relief, but dealers aiming to get hundreds of buy-side firms over the documentation finish line by September 1, 2020 fear a compliance bottleneck

EU to grant last-minute margin reprieve for equity options

European Commission to publish changes to Emir technical standards within days

Asia exotics desks eye forward vol as corridor variance wilts

Forward-starting options offer discounted vol to hedge funds as dealers recycle autocall risk

Derivatives exchange of the year: SGX

Asia Risk Awards 2019

Currency risk drives EU equity fund derivatives use

Just 27.6% of Ucits equity funds traded derivatives in Esma sample

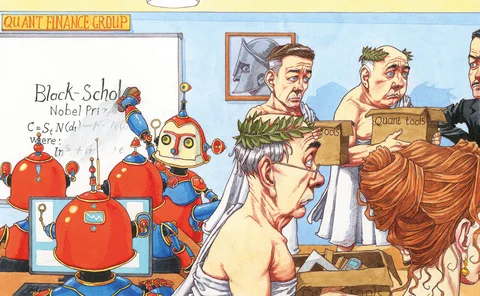

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

EU banks seek last-minute margin reprieve for equity options

European dealers want exemption rolled over, to avoid handing US firms a regulatory advantage

Capitalab completes first compression run with SGX

Compression efficiency in SGX Nikkei 225 options could be as high as 50%, Capitalab says

JP Morgan turns to machine learning for options hedging

New models sidestep Black-Scholes and could slash hedging costs for some derivatives by up to 80%

Skewing quanto with simplicity

George Hong presents an analytical method for pricing quanto options

Autocall concentration weighs on dealers

Hedging headaches force issuers to seek new structured product blockbusters

Autocall dealers wary of Nikkei volatility surge

Dealers caught in danger zone as losses lurk on upside and downside spikes

Berkshire Hathaway dinged $300m by equity index options

Derivatives have netted conglomerate $2.2 billion in gains since 2004

Bank risk manager of the year: UBS

Risk Awards 2019: Bank heeds lessons of past structured products routs to navigate February volatility