Emissions

‘Trump digs coal’ – but is that enough?

Are Trump's efforts to support US coal levelling the playing field for fuel sources, or flogging a dead horse?

US carbon trade surviving below the radar

State-level carbon trading markets are thriving without federal support

No escape from climate change tail risks

Harsh decisions need to be made on the future of energy financing now, before we run out of time

Climate risk joins ethics in driving lending decisions

Barclays, BNP Paribas and others are analysing risk of climate change-related losses

Credit data: ‘dirty diesel’ woes weigh on autoparts firms

Auto supplier default risks have jumped, as environmental concerns hit prospects for diesel vehicles, says David Carruthers of Credit Benchmark

Speculators flock back into the EU carbon market

EU reforms trigger carbon rally set to last through 2018

Emissions house of the year: BP

Energy Risk Awards 2017: Energy giant aims to shape emissions trading

February seen as crunch time for the EU ETS

Carbon price could soar by 2020, but traders bearish short-term as EU votes on final package

Brexit roils UK electricity firms’ carbon hedging plans

Utilities may unwind hedges amid uncertainty over EU emissions market

Basel may soften trading book rules on emissions

Latest FRTB tweaks also include increasing granularity of commodity risk weights

Mifid II adjustments fail to ease energy firms' worries

Revised ancillary business exemption would still catch large and mid-sized utilities

Ask questions and avoid sure bets, energy traders told

E.on Global Commodities CRO calls for disciplined approach to trading decisions

Asian emissions markets seen as step in right direction

China and South Korea emissions schemes show promise, say industry groups

Connecting global energy

Sponsored feature: E.ON

Carbon trading firms positive about future of EU ETS

Market participants optimistic due to political support, survey finds

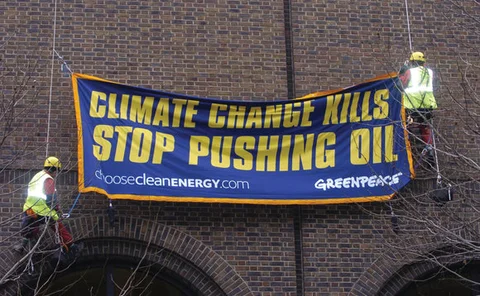

Looking back: Chaos ensues at IPE amid protest

Greenpeace activists burst into exchange ‘commando style’

Renewables in Europe: A roadmap for fundamental reform

Efet board member calls for dramatic overhaul of subsidy regimes

EDF Trading environmental products head leaves firm

Fabio Nehme leaving to set up own commodities business

Emissions House of the Year: Element Markets

Firm offers wide array of services across environmental commodities

Carbon reform may be shaken by European Parliament vote

Fringe gains could see proposals to modify emissions market suffer

Carbon emissions trading spreads across the globe

California, RGGI, China and UN offset markets show potential