Debt

Dealers vie with Markit to electronify bond issuance

Competing platforms could split the market for new issuance in Europe and the US

Eurozone insurers dived back into bonds in Q2

Net purchases of debt securities amounted to €15.1 billion over Q2

Network sensitivity of systemic risk

Here, we address the more general problem of how shock propagation dynamics depend on the topological details of the underlying network. To this end, we consider different realistic network topologies, all consistent with balance sheet information…

Eurozone funds charged into overseas debt in Q2

Net purchases almost reversed the first quarter’s fire sale

Asia debt market suffers SOFR inertia

Issuers of floating rate notes stick with Libor in absence of term version of risk-free rate

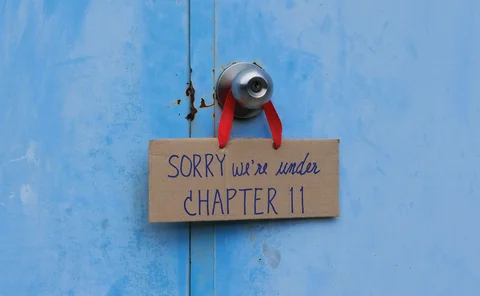

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

China bond buyers tiptoe through credit analysis minefield

State backing for domestic companies is hard to gauge, as new investors are discovering

Why credit risk managers need to see around corners

The Covid‑19 pandemic – and the subsequent extreme volatility – has exposed the fragility of long-established market and supply chain systems, affecting borrowers’ ability to repay debt. David Croen, global head of credit risk products at Bloomberg,…

Safe havens no longer safe, quants fear

Equity-debt correlation breakdown and negative bond yields make investors nervous

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

CDX on junk bonds jumped 65% in H1 2019

Notionals to which CCPs were counterparty increased +85%

Systemic US banks’ trading portfolios swell 10% in 2019

US Treasuries held-for-trading soar 28% on Q4 2018

Equity gains bolster EU hedge funds’ portfolios

Funds were net sellers of equities, but market gains added +10% to balance sheet values

‘Rounding errors’ prompt EBRD to break with Sonia FRN norms

Index-friendly coupon structure touted as a template for future issuance in the UK market

Asia moves: Natixis hires Asia M&A chief, Deutsche Bank picks north Asia head, and more

Latest job news across the industry

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Bank risk manager of the year: HSBC

Risk Awards 2020: New market risk system proves its worth in a year of emerging market blow-ups

Costs of capital under credit risk

In cost-of-capital computations, credit risk is only taken into consideration at the level of the debt beta approach. We show that applications of the debt beta approach in company valuation suffer from unrealistic assumptions about the market index and…

Goldman leads US banks on trading VAR, but not on revenue

NY-based dealer makes $9.1bn trading revenue year-to-date to JP Morgan’s $18.7bn

Low investment grade debt a staple of EU insurer portfolios

Debt holdings just one notch above junk status make up €642.8 billion of standard formula insurer assets

The theoretical foundations of XVAs

Bloomberg analyses the theoretical basis of XVAs, focusing on the works and findings of its head of quantitative XVA analytics, Mats Kjaer, who emphasises the role of the capital valuation adjustment as a major driver of derivatives trading profitability…

Fed underscores run risk of corporate bond funds

Total AUM of junk bond and bank loan funds was around $350 billion in Q2 2019

Debt and the oil industry: analysis on the firm and production level

This paper analyzes the relationship between debt and the production decisions of companies active in the exploration and production of oil and gas in the United States.