Data

HTM securities hit $2.5trn at US banks in 2022

BofA, First Foundation and Wells Fargo reported largest share of HTM to total securities behind SVB

Fed’s climate stress test whips up storm for banks

Long-awaited US climate risk exercise puts tough pressure on banks’ data and models

High-frequency flap over CME’s Aurora data centre

FIA Boca 2023: Exchange group’s migration to Google’s cloud could render HFT networks redundant

Top 10 operational risks for 2023

The biggest op risks for the year ahead, as chosen by senior industry practitioners

Mystery upstarts crash Robinhood’s retail options party

SEC filings hint at wider shake-up in wholesale options market-making

EC stuns corporates by scrapping Emir swaps exemption

Industry confused as to why intragroup reporting obligation needs resurrecting

Smarter data: steering a course in volatile markets

Fixed income markets are entering a new era of turbulence. This paper outlines the challenges facing asset managers in this macro environment and how to overcome them through high-quality data and cutting-edge analytical tools that uncover alpha and…

Data shines light on Tibor fragility

Lack of actual transactions in D-Tibor should be considered in fallback discussions

HKMA preparing prescriptive climate stress test for 2023

Regulator plans granular scenario specifications, considers Pillar 2 capital measures

FSB: third of climate stress tests not tackling physical risk

Six jurisdictions conducted exercises only for transition risk

Credit risk: best practices for predicting future risks

In today’s uncertain times, credit risk managers are under increasing pressure to provide robust, forward-looking insights on counterparties. Fitch Solutions explores the key pain points in the process and crucial steps to improving data quality

Getting op resilience right: breaking down silos and developing a cohesive data strategy

As banks further define their frameworks for operational resilience, firms are now grappling with developing a cohesive data strategy, correlating regulatory expectations and defining concrete outcomes. This Risk.net webinar covers how leading banks are…

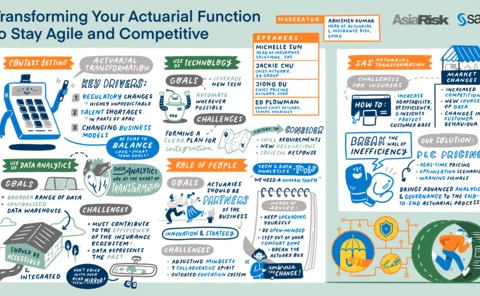

Transforming your actuarial function to stay agile and competitive

While transformation is important, its success depends on putting data in capable people’s hands

Maximising value from ESG data

Bloomberg’s Brad Foster discusses the latest trends in environmental, social and corporate governance (ESG) data usage by capital markets firms

Navigating the complex world of equity options data

In an exclusive Risk.net webinar, convened in collaboration with Cboe Global Markets, experts discussed the expanding world of equity options data, the rise of retail investment within it, and the technological challenges and opportunities associated…

As interest rates surge, bankers fret over last year’s models

IRRBB modellers trying to predict client behaviour have little relevant data to fall back on

Sculpting implied volatility surfaces of illiquid assets

From the stock cumulative distribution function an arbitrage-free volatility surface is derived

European banks set for 17.5% capital hike under Basel III

Output floor could account for almost half the increase in Tier 1 capital requirements by 2028

Navigating the increasingly complex world of equity options data

With market volatility and retail participation impacting quoting activity on the Options Price Reporting Authority, asset and portfolio managers are struggling to identify the real price of instruments, aggregate data in real time and run-risk…

ALM solution of the year: Moody’s Analytics

Asia Risk Awards 2022

Decision science: from automation to optimisation

The full benefits of investing in a digital approach to credit decisioning are yet to be unleashed, despite advancements in automation and analytics at banks

Fraud prevention solution of the year: Quantexa

Asia Risk Awards 2022

Market data vendor of the year: ICE Data Services

Asia Risk Awards 2022

Risk data repository of the year: Moody’s Analytics

Asia Risk Awards 2022