Credit risk

Asset price bubbles and the quantification of credit risk capital with sensitivity analysis, empirical implementation and an application to stress testing

This paper presents an analysis of the impact of asset price bubbles on standard credit risk measures.

Stage fright: banks tackle IFRS 9 loan-loss volatility

Banks look to counter volatility of loss provisioning through careful calibration of loan buckets

What the ambitions of China’s banks mean for Hong Kong

Political war of words over former colony means little; it’s the appetite of mainland banks for local dominance rivals should watch

Monthly credit data review: PDs imply Brexit stress

Default risk for group of UK corporates has risen 11% over the past year

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

Finding alpha in uncertain energy markets

Sponsored webinar: FIS

Managing and monitoring a single view of concentration risk

Content provided by IBM

Monthly credit data review: new-tech scepticism

David Carruthers of Credit Benchmark looks at the most recent trends in bank-sourced credit data

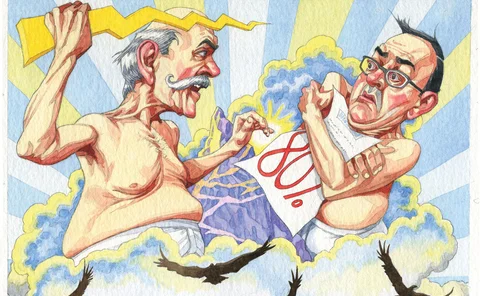

Memo to bank CEOs: treat op risk with more respect

High-profile critics of op risk capital rules are misguided, say Ariane Chapelle and Evan Sekeris

Risk managers in power struggle over IFRS 9 model development

Putting accounting specialists in charge of IFRS 9 models is ‘not optimal’

Banks diving into credit data pools as official support grows

European regulators embrace external data for internal modelling of credit risk capital

Volatility of IFRS 9 loss estimates alarms lenders

Accounting model outputs wildly out of sync with those used to calculate regulatory capital requirements

EU capital revamp paves way for corporate CVA charge

Draft directive offers national regulators power to override controversial exemption

Monthly credit data review: gloomier than spreads suggest

David Carruthers of Credit Benchmark looks at banks’ credit risk data

Banks look to repurpose credit risk models for IFRS 9

Dealers adapt capital models for new accounting standard, but shortcut has challenges

CLO investors fret as rate hikes loom

Rising default rates could trigger a stampede out of the market

Rating momentum in the macroeconomic stress testing and scenario analysis of credit risk

This paper focuses on the corporate stress testing models for credit risk.

A model combination approach to developing robust models for credit risk stress testing: an application to a stressed economy

This paper uses a model combination approach to develop robust macrofinancial models for credit risk stress testing.

Cramped by cramdowns: national hurdles for EU insolvency plan

Proposal to harmonise rules on debt stays and holdout creditors touches on sensitive issues

Credit portfolio manager of the year: BNP Paribas

Risk Awards 2017: Guarantees and insurance help French bank cut RWAs by €3bn – and limit use of CDSs

Financial distress pre-warning indicators: a case study on Italian listed companies

This paper focuses on the ability of accounting ratios to predict the financial distress status of a firm as defined by the law.

Crunching mortality and life insurance portfolios with extended CreditRisk+

Jonas Hirz, Uwe Schmock and Pavel Shevchenko present a summary of actuarial applications of the extended CreditRisk+ model

Systemic risks in CCP networks

Barker, Dickinson, Lipton and Virmani propose a credit and liquidity risk model for CCPs