Credit risk

Tougher OTC trading conditions to persist, say European banks

Seventy-three per cent of respondents expect tight price and non-price terms through September

Elliptical and Archimedean copula models: an application to the price estimation of portfolio credit derivatives

This paper explores the impact of elliptical and Archimedean copula models on the valuation of basket default swaps.

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

US banks’ corporate default indicators worsened in Q2

Median probability of default increases 38bp to 1.7% on the quarter

Systemic eurozone bank provisions hit €11bn in Q2

ING sees loan-loss charge double in Q2

FX swaps platform aims to cut out the banks – but not entirely

Peer-to-peer newcomer FX HedgePool targets asset managers’ month-end hedging activity

CRR ‘quick fix’ pushes UniCredit’s RWAs lower

Italian bank nets €2.4 billion of RWA relief from regulatory changes

Shift out of models nets ING €8bn of sovereign RWA relief

Of standardised approach government debt exposures, 24% had a zero risk-weighting in Q2

EU banks’ Q1 credit risk estimates show little Covid effect

Probability of defaults for retail exposures edged up only slightly quarter-on-quarter

Corporate, SME loans to take brunt of Covid shock, say EU banks

Though credit outlook has darkened, banks expect to increase lending overall

IFRS 9 and the loan loss lottery

As reserves for bad loans balloon, banks grapple with measuring Covid-era credit risk

The unintended impact of collateral on financial stability

Initial margin requirements for OTC derivatives can increase risk of contagion, writes economist

Dark Covid outlook pumps up Lloyds’ loan-loss reserves

Base case for 2020 now projects UK GDP to drop 10%

Coronavirus crisis sours €8bn of Santander’s loans

Loans moved into IFRS 9 stage two to reflect significant increase in credit risks

Relief for credit losses buoys Barclays’ capital ratio

IFRS 9 transitional measures added 35bp to CET1 ratio

Pimco’s Mariappa on iterating through the Covid-19 crisis

Buy-side risk survey: bond giant’s risk head is paying closer attention to idiosyncratic risks

Top US banks reined in RWAs in Q2

Credit exposures fall after a wild first quarter

Good citizenship can signal better creditworthiness – study

Environmental and social behaviour predicts credit ratings in North America – less so in Europe

Credit scenario update drives UBS loan-loss reserves higher

Gloomier US outlook contributes to $272m of Q2 provisions

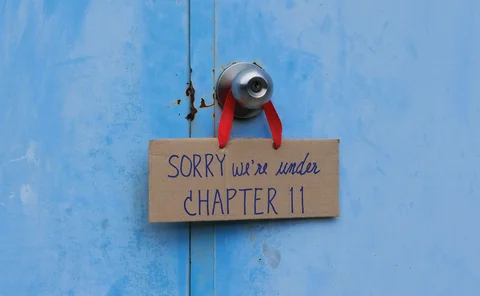

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

Stuart Lewis, Deutsche’s survivor, confronts Covid-19

CRO talks loan reserves, VAR breaches, and the lessons of a lurid past

At Danske Bank, market RWAs soar as credit risks dip

Bond binge contributes to 36% increase in market risk charge

Q&A: New York Fed’s Stiroh on climate change and Covid

Co-chair of Basel task force discusses possible supervisory approaches to climate risk

Systemic US banks put aside $35bn for credit losses in Q2

JP Morgan takes a $10.5 billion provision charge alone