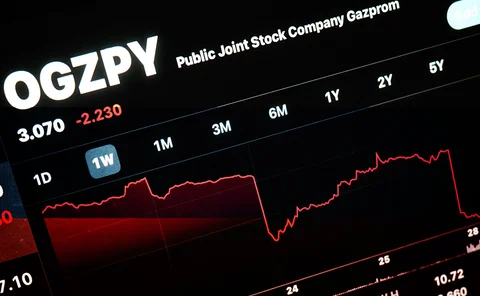

Credit default swaps

Pimco loses $400m on failed Russia CDS bets

Revised markdowns suggest bond giant has already crystallised losses on sold credit default swaps

CDS market mulls settlement options for Russia contracts

Tightened US sanctions threaten CDS default auction, leaving users a choice of imperfect alternatives

CDS notionals made a comeback in 2021

A 5% rise to highest end-year figure since 2017 driven by swaps on junk debt

Mind the gap

A default intensity model reveals the risk carried by a highly leveraged counterparty

CDS users mull ‘uniform’ price as Russia fallback

Pricing agreement could replace dealer estimates if sanctions scupper default auctions

CDSs may not cover final coupon on $149bn of Russian bonds

Some derivatives contracts expire before end of final grace period for distressed corporate bonds

Morgan Stanley bests Goldman as top US fund single-name CDS dealer

Counterparty Radar: Single-name corporate volume hits record high as Pimco increases positions

US funds continue expansion of sold CDS protection

Counterparty Radar: Pimco leads charge with $57 billion in total sold positions

Russian invasion stirs up ‘perfect storm’ for XVA desks

Declining credit quality of Russian companies and spike in inflation threaten CVA and FVA double-whammy for banks

Norway oil fund’s derivatives book balloons 192% in H2 2021

Sovereign wealth fund GPFG piled up FX and IR contracts and tapped CDS for the first time

Pimco, Franklin Templeton affiliates top for Russia exposure

Counterparty Radar: Funds had biggest long exposures to Russia across credit, rates, FX at end of Q4

CDS committee to rule on scope of eligible Russian debt

Group will determine whether bonds with ruble payment options can trigger the contracts

Credit default swaps on Russian companies face uncertain future

With CDS auctions on sanctioned companies unlikely, traders may have to rely on dealer estimates

Market set to reject SEC’s anti-fraud CDS rules ... again

Industry groups dislike retread of rules around fraud and manipulation, and want longer comment period

Credit derivatives house of the year: BNP Paribas

Risk Awards 2022: Relative value trades propel French dealer into US top tier for index and single names

How PGGM made 11% a year selling credit protection to banks

Dutch investor expects returns to drop over time unless rising inflation widens risk premia

XVA in Japan: the outlook for 2022

Hiroyuki Yoshizawa, executive director, pricing valuations and reference data at IHS Markit Group Japan explores why financial institutions that were early-accounting CVA adopters are now taking the next steps on their XVA journeys

JSCC member received $3bn cash call in Q3

The CCP revised its estimate of the worst-case payment obligation that would have to be met should one of its participants collapse

Pimco, Capital Group lead expansion of index CDS market

Counterparty Radar: Total positions reach new high driven by growth of swaps referencing CDX NA IG

SEC’s Peirce sees legal risk for dealers in new swap rules

Anti-fraud provision in proposal could expose margin calls to “potential liability”

Evergrande stress boosts fledgling China CDS indexes

Interest surges in products seen as better gauges of credit risk for embattled property sector

Europe swap dealers eye London return post-Brexit

Proposed Mifid exemption paves way for BNP Paribas, SocGen and Deutsche to trade swaps on UK venues

You’ve got a Frandt: banks set to port EU clearing rules to UK

FCMs set to adhere to higher standard on commercial terms for swaps clients

Single-name CDS trading bounces back

Volumes are up as Covid-driven support fuels opportunity for traders and investors