Covid

Banks reject SOFR in Fed’s Covid lending schemes

Emergency loans to businesses get caught up in Libor transition

US banks’ leverage soared in Q1 before Fed’s reprieve

JP Morgan alone saw leverage exposure climb $112 billion

How regional banks could shape US Libor replacement

Regulators convene working group to address credit sensitivity concerns

FRTB comes too late for Covid crisis

Expected shortfall would stop Basel 2.5 duplicate capital charges, but backtesting still a problem

EU banks diversified sovereign holdings in 2019

Yet banks in peripheral eurozone countries still heavily exposed to home government risk

BoE and ECB weigh calls to follow US lead on capital relief

European regulators face pressure to exempt sovereign exposures from leverage ratio

Amid Covid crisis, top US banks give $32bn away to shareholders

Buybacks exceeded Q1 2019 total, despite voluntary suspension on March 15

CCPs postpone euro discounting switch to July

Five-week extension agreed after working group proposal for September delay fails to find consensus

Managing a derivatives portfolio through turbulent markets

Steering a portfolio of non-linear derivatives, such as options and more exotic products, is challenging at the best of times. Market risks change as markets move and time passes, risks offset in complex ways and proxy hedging is common. In this feature,…

Fed dominated MMF repo trades in March

FICC and BNP Paribas among other top repo counterparties

Quants pitch in to improve pandemic models

The finance industry’s quants are trying their hand at modelling the virus and its economic impact

Goldman Sachs’ VAR hits five-year high

Higher market risk accompanied bumper trading revenues in Q1

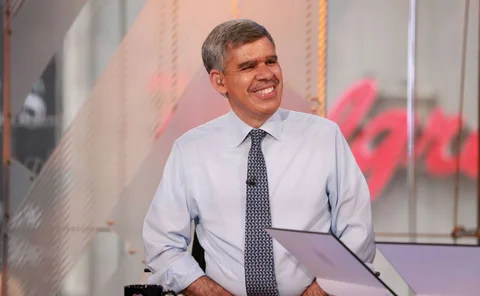

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Eurozone banks fear market risk capital hike due to Covid-19

Hopes that ECB will fix double-counting as VAR breaches rise on market volatility

Virus weakens banks’ defences against internal fraud

Stressed markets and remote working leave firms vulnerable to op risks and cyber attacks

How Goldman’s algos adapted to virus vol

Interview: Ralf Donner explains why algo usage is up while markets are down

Wells Fargo loan book swells $48bn in Q1

San Francisco-based bank clears space on balance sheet for increased lending

Covid-19 tumult is testing AI fund returns

Some ML strategies have coped well, but others began to struggle as panic mounted

How the Fed’s asset cap changed Wells Fargo

Lender has expanded repo book and cut cash since Q4 2017

Swaps data: how the market responded to Covid-19

Swap rates saw massive moves as volumes peaked, writes Amir Khwaja of ClarusFT

Lloyds and Riverside rehitch revolving loan to Sonia

£100m Sonia facility overcame late operational hurdles to be among the first done since the onset of coronavirus

Banks fear time-limit on Fed leverage ratio reprieve

Capital constraints not covered by relief also weigh on balance sheet strategy

Japanese dealers join calls for Libor extension

Local firms struggle to adapt to remote working as coronavirus throws benchmark transition plans off course

After coronavirus rout, concerns raised about Simm

Annual recalibration means March volatility will not be reflected in margin until end-2021