Correlation

Marrying correlation and asset allocation

Coping with correlation

Equity derivatives

Equity derivatives special report

Equity investors struggle with high correlation

Dealing with a break-up

Demand for downside puts keeps skew high

The turn of the skew

Cross-asset correlations pose opportunities - and threats

Opportunities and threats

Quant unlocks the physics of the flash crash

The flash crash was statistically distinct from other market panics, and can be understood with a little help from the physics of supercool magnets

15 minutes with: Stacy Williams, HSBC

Senior quant discusses the high levels of cross-asset correlation across today's markets

Breaking correlation breaks

Breaking correlation breaks

Analysing correlations under stress

Analysing correlations under stress

Structural shifts in equity flows and ETFs force up correlation, says HSBC

HSBC's global report indicates that correlation in the global equities market has been steadily rising since 2001.

Banks struggle with Basel 2.5

Challenging change

Structured products

Special report

ETFs under the spotlight amid high correlation

All together now

Mizuho provides a model model for AMA in Japan

Japan’s regulator points to Mizuho Financial Group’s operational risk management model as an example for banks in the country to follow. Shigehiko Mori, the group’s head of operational risk, talks about how the model works and his plans for continued…

The rise of multi-currency options

Adrian Campbell-Smith (RBS Currency Options Trading) and Ben Hamdani (RBS Currency Structuring) examine the realm of multi-currency options and explain some of the reasons behind their increasing popularity

Playing on forex correlation

The eurozone crisis sent market participants scrambling to put on macro hedges. A popular trade was to short the euro, but with the cost of this strategy escalating, some turned to correlation products. By Christopher Whittall

Kempen's property sector play

Access to property

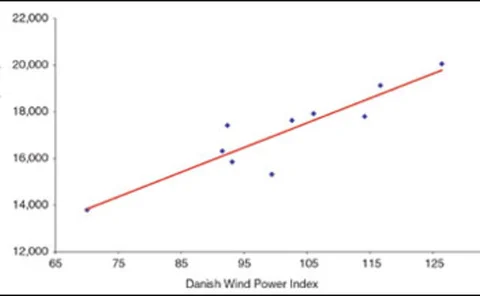

Volatility, correlation and skew too

Surviving skew

High yield spreads no longer correlated to default rates: Jerry Tempelman column

High yield spreads are more highly correlated to the VIX index than to default rates.

Morgan Stanley Jump

Morgan Stanley has issued Jump Securities, a structured products based on the performance of a basket composed of the iShares MSCI Emerging Markets Index Fund and the Dow Jones Eurostoxx 50. Principal is not protected and the upside above the target…

Malaysian investors hunt for hybrids

Hybrid structures are increasingly popular in Malaysia as investors look to keep the cost of hedging down and moving away from capital protected products

Surviving skew

Skew skyrocketed in May, breaking through levels last reached in 2008 after the bankruptcy of Lehman Brothers, while volatility and correlation also spiked. The dislocations are rumoured to have caused losses for some exotic equity books. How did dealers…