Constant maturity swaps

Playing the yield: rates rev up structured products

Higher government bond yields and steeper forward curves fuel demand for new range of fixed income structures

Taking the measure of CMS pricing

Bank of America quants propose comprehensive framework for modelling rate derivatives

CMS pricing: overdue annuities

An RFR-based pricing and risk management model for CMS and its derivatives is presented

Valuation and risk management of vanilla Libor swaptions in a fallback

A procedure to price vanilla European Libor swaptions derived from the SABR model is presented

How derivatives management is changing post‑Covid‑19

Risk.net explores five derivatives trading themes discussed by experts in a recent webinar sponsored by Numerix

Government bond swaptions and how they might work

Payoffs based on bond yields instead of swap rates could offer new hedging tool, argue Crédit Agricole execs

Tradition to launch first SOFR order book

Streaming swap prices are a critical step to creating term rates for loan markets

Ice swap rate adds safety net with Tradeweb quotes

Inclusion of dealer-to-client prices will boost publication rate in stress periods, IBA claims

Swaps benchmark vanishes as traders flee firm price venues

Dollar Ice swap rate fails to publish in March rout; patchy Sonia Clob prices could delay term rates

Dealers rush to redeem high-yielding structured notes

An estimated $60 billion of structured notes are at risk of being called before year-end

Evolution or extinction: Ice swap rate’s post-Libor quandary

Thin liquidity in SOFR swaps imperils reference rate for $40 trillion swaptions market

Fixing floaters: how the 10y10y rate can save FRNs

Experts from Crédit Agricole’s rates team explain how use of a forward euro fixing can bring positive carry and improve coupons

Local stochastic volatility: shaken, not stirred

Dominique Bang introduces a novel LSV approach to term distribution modelling

Korean insurers shun structured notes ahead of IFRS 9

Prospect of earnings volatility blamed as big buyers of notes turn to less exotic assets

Ripple effect: The impact of moving away from Libor

Sponsored Q&A

Duelling repack platforms find common ground

Standard documentation initiative mulls shared SPV model as founders seek to join rival

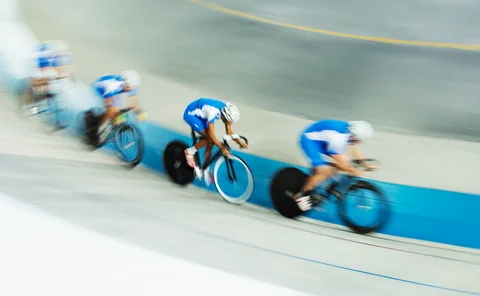

Putting swaptions pricing in the fast lane

Derivatives consultant proposes a model for arbitrage-free pricing

Discrete time stochastic volatility

Quant proposes faster model to price arbitrage-free swaptions

Interest rates house of the year: Societe Generale Corporate and Investment Banking

Multi-asset capabilities and risk recycling allow the bank to bring hit solutions to the market

Asian private bank clients switch to rate structures

Stock market falls steer clients away from traditional equity focus

Deal of the year: Crédit Agricole Corporate & Investment Bank

French bank triumphs with bond repack