CCAR

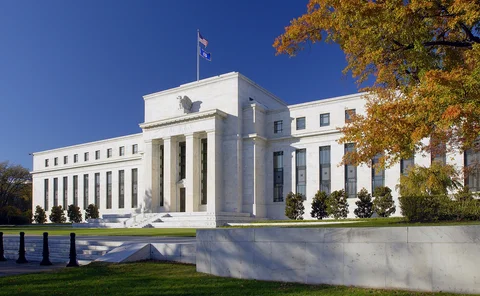

WHAT IS THIS? The Comprehensive Capital Analysis and Review (CCAR) is a stress test carried out by the US Federal Reserve. It aims to establish whether the largest banks have enough capital to cope with a severe economic shock, and vets their risk modelling practices. CCAR was initially devised as a stand-alone stress test regime but in 2020 the Fed merged it into the wider DFAST stress test.

Deutsche Bank fails CCAR; Goldman and Morgan Stanley scrape by

DB USA hit with qualitative fail, while Goldman and Morgan Stanley face dividend and buyback freeze

Fed stress tests stretch State Street, Goldman, Morgan Stanley

State Street worst performer among complex firms on capital; Goldman and Morgan Stanley on SLR

CCAR winners and losers 2012–17

American Express came off worst under CCAR total capital ratio measure among large and complex firms three years out of six

New US buffer triggers fresh focus on CCAR transparency

Banks fear capital volatility and may also push for changes to US G-Sib surcharge

Citi’s CRO on the importance of risk sensitivity

Brad Hu talks modelling, CECL and setting risk culture

Citi CRO: stress tests now vital part of bank strategy

Bank has leveraged CCAR to build culture of constant internal stress testing, says Brad Hu

Op risk capital: why US should adopt SMA today

No reason to delay roll-out of standardised approach, says TCH’s Greg Baer

CCAR compels CET1 build-up at Capital One

The bank is targeting a CET1 capital ratio of 11% in 2018

Fed risk rating system unifies stress testing and 3LOD

Some banks have qualms over potential downgrades and overlap between first and second lines

CCAR threatens BNY Mellon dividend payout

Fed's test "noticeably more stringent" - BNY Mellon's Santomassimo

US Bancorp unfazed by Fed’s new capital buffer

Lender targets dividend payout ratio of 40%

Quarles: Fed would recalibrate eSLR if Crapo bill passes

Senate or House changes to CCAR could also affect Fed’s new stress capital buffer

Goldman shakes off tax reform capital effects

Stronger regulatory ratios support capital distributions

Fed’s new capital buffer refocuses on risk

Low-risk activities and larger management buffers likely to become more attractive

ECL regimes a volatile brew of risk and accounting

Fed asks banks to propose a solution to address CECL-CCAR mismatch

CCAR gives op risk modelling a new lease of life

OpRisk North America: Fed’s annual stress tests are rehabilitating ‘black box’ op risk modelling

CECL vs CCAR: banks fear loan-loss reserves mismatch

Lifetime loan loss estimates will look much worse under CCAR stress scenarios than accounting measure

Trump tax reform sours US banks’ CCAR outlook

Tax changes hit bank capital ratios; Goldman, AmEx could fail Fed’s annual tests

JP, Citi may not see capital benefit from new op risk rules

Collins floor may also prevent Morgan Stanley, State Street and Wells Fargo from realising SMA savings

Fed backtracks on CCAR cleared swaps exposure

Regulator had also postponed plan to feed cleared client exposure into G-Sib rankings

Banks apply machine learning to CCAR models

ML models benchmarked against traditional iterations to avoid ‘black box’ perception

Fed willing to listen on CCAR transparency calls

Central bank will seek industry input on bolstering transparency of stress test regime, says Quarles

Banks prepare for battle with Fed over G-Sib rules

Proposals would kill client clearing business, FCMs claim – but postponement is a chance to fight back

Model validators squeezed by stress test deadlines

CCAR cycle frustrates compliance with Fed model risk guidance