Collateralisation

Standard CSA: Industry's solution to novation bottleneck gets nearer

New CSA, new challenge

Corporates fear CVA charge will make hedging too expensive

Crunch time for corporates

Bank of England's FPC seeks to unlock Basel III tool-kit

Systemic risk committee at the Bank of England calls for power to use tools - such as liquidity and leverage ratios, and margin standards - to influence systemic risk

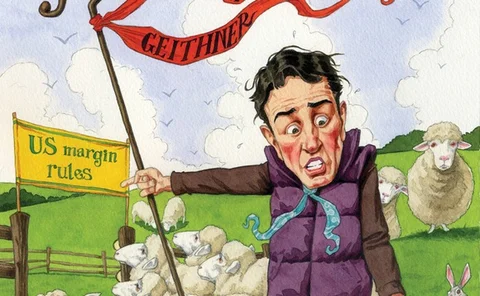

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

Standard CSA: Industry's solution to novation bottleneck gets nearer

New CSA, new challenge

Irish debt office agrees to collateralise derivatives

The NTMA follows Portugal's debt office in adopting two-way collateralisation - but unlike Portugal it appears it will have to post cash

Sovereign volatility puts Basel III CVA charge in spotlight

Basel III feedback loop between CDS spreads and CVA capital requirements worries dealers, following month of huge sovereign spread moves

BNP Paribas takes €108 million hit on swaps after switch to OIS discounting

French bank becomes the latest to divulge a revenue impact from a change to overnight indexed swap discounting

Non-US sovereigns should collateralise swaps, say US bank regulators

Progress towards sovereign collateral posting has been slow. Now, US regulators are proposing to make it mandatory - for all non-US entities