Collateral

Lessons from two commodity defaults

Regulators and exchanges need to learn from the Greenhat/PJM and Norwegian Nasdaq defaults

Ibor transition valuation and risk management considerations

The impending move from interbank offered rates to alternate reference rates will require important changes to many valuation and risk management processes and infrastructure. EY Financial Services’ Shankar Mukherjee, Michael Sheptin and John Boyle…

RFR valuation challenges

A new system of interest rate benchmarks for all major currencies is emerging. These new benchmarks will replace interbank funding rates with risk-free rates (RFR). This article by LPA focuses on valuation challenges during the transitional period to new…

Collateral manager of the year: BNY Mellon

Asia Risk Awards 2018

Preparing for the initial margin phase-in

Requirements for the mandatory exchange of initial margin are expected to be time‑consuming and laborious to implement. David White, head of sales at triResolve, discusses the lessons learned from in‑scope firms, obstacles to achieving compliance and how…

US LCR cash inflows dominated by secured loans

Median US systemically important bank counts secured loans as 73% of total cash inflows

OCC swells liquidity after reinforcing clearing fund

Further changes expected following September clearing fund revamp

Industry seeks smaller ‘big bang’ for margin

New study supports sixfold hike in 2020 compliance threshold to avoid “dormant” margin accounts

Initial margin – Preparing for the buy‑side ‘big bang’

Video Q&A: David White, triResolve

Eonia woes hold up euro swaptions switch

Eleventh-hour derailment for project that has been in the works for a year

CCPs must step up cyber risk efforts, says EU legislator

Policymakers want more focus on non-default loss resources; Eurex Clearing’s Mueller flags investment risk

Safeguarding liquidity in a changing environment

Nick Gant, head of fixed income prime brokerage for Europe, the Middle East, Africa and Asia-Pacific at Societe Generale Prime Services, discusses banks’ evolving responsibilities for providing liquidity in a post-financial crisis environment in which…

The rapid evolution of compression: Keeping pace with optimisation activity

Sponsored forum: Capitalab

The case for draining excess reserves

The financial system can operate efficiently with $500 billion or less in reserves after normalisation

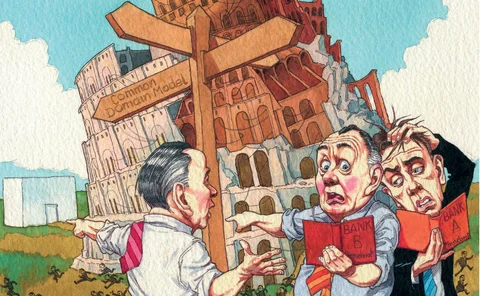

The battle for the back office

Post-trade incumbents at risk as Isda and others search for standards

A floored plan: Europe’s CCP recovery rules draw fire

CCPs and clearing members both unhappy with proposed allocation of non-default losses

European legislators to exempt CCPs from new bank rules

Support in Council and Parliament suggests leverage ratio, NSFR exemptions will be in final text

Breaking the collateral silos – Navigating regulation with a strategic alternative

Emmanuel Denis, head of tri‑party services at BNP Paribas Securities Services, discusses why financial institutions must rethink old practices of collateral management and instead adopt a tri-party approach, with which equities can be managed as…

Initial margin with risky collateral

This paper explores the complication of calculating the IM amount requirement when collateral comprises risky assets in a parametric VaR framework. The authors show that the required IM amount can be calculated by solving a quadratic inequality.

VM rules sound death knell for forex swaps in Europe

Market participants claim instrument was a “mythical creature” that never really existed

EU sparks hopes of securitisation margin reprieve

Optimism over EU Council amendment, but Parliament will still have to approve

UBS’s Athanasopoulos on volatility, Mifid and hedging by machine

Risk30 profile: Athanasopoulos sees opportunities to cut hedging costs

Goldman swaps assets drop $140bn after margin change

Move follows guidance from US regulators; no word from Goldman on capital impact