Clearing

Cleared sovereign CDS volumes build as pandemic spreads

South Korea and Italy CDS vols dominate Ice Clear Credit and Ice Clear Europe, respectively

Coronavirus rout revives attacks on futures margining

FCMs call for permanently higher margins following “unprecedented” number of breaches

Banks rail against China CCPs’ loss-sharing policy

Controversial loss allocation technique remains unused during recent market routs, but banks want it banned

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

Oil price shock triggers big margin calls

Banks and exchanges worked through weekend in anticipation of oil collapse

Apac CCPs: we’ve come a long, long way together

Members still gripe about arcane policies, but risk management fundamentals are strong

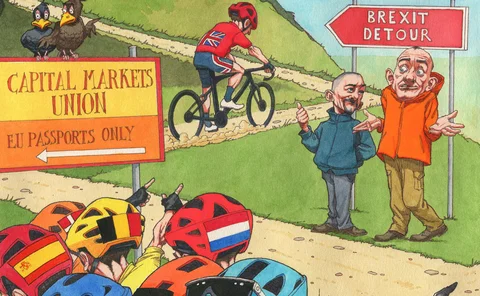

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

FCMs clamour for formal rule on separate account margin

Costly compliance effort will be to no avail if CFTC relief expires in June 2021

Clearing members in cash clash with Apac CCPs

Banks and clearing houses wrangle over who should pay for losses on invested collateral

EU banks rue SA-CCR mismatch with US

European clearers are stuck with CEM until 2021, but some US banks are reluctant to switch early

FCMs’ required client margin up 29% in 2019

Citi still far and away the largest FCM

BNP leads a comeback for Europe’s clearers

Brexit, leverage ratio tweaks and concentration fears could help European banks compete with US FCMs

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

OCC updates default auction rules to encourage buy-side bids

Clearer’s proposed changes follow client fears of being locked out

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

Top five clearing members dominate CCPs

Thirteen of 25 clearing services surveyed have 50% or more open positions in hands of top five members

At CCPs, sovereign bonds are top IM collateral

Government debt makes up 48% of IM on average among top clearing houses

EU council dials back on margin haircuts for CCP resolution

Lawmakers close avenues for regulators to dip into non-defaulting members’ initial margin

As business mix shifts, Eurex bulks up its default fund

Clearing house will raise charge to 9% from 7% as stress tests signal need for a fatter fund

Inside top CCPs’ default funds

Central banks favoured by CCPs to hold default resources

CCP risks, Sonia shift and CVA carve-out

The week on Risk.net, January 4–10, 2020

European CCPs home to 241 non-bank clearing members

Majority of non-financial counterparties are energy and power firms