Clearing

CFTC rule change sparks dealer-client margin scuffle

FCMs fear “race to the bottom” as funds lobby dealers for lower margin status

No clearing sweeteners for European SSAs, argue dealers

As public entities eye CCP membership, dealers warn of heightened risk exposure from support waivers

Bank of America cleared swaps jump $6.6trn

Bank’s quarterly increase leads US G-Sibs’ $25trn rise in Q1

CME, FICC to overhaul Treasury market margining

Clearers eye deal to dramatically improve cross-margin savings, aim to extend offsets to end-users

BoE’s post-Libor clearing plan leaves yen swaps in limbo

Sonia and €STR will be mandated for clearing, while Tonar must wait until liquidity settles

CDS market prepares to join Libor transition

Ice and LCH will switch to new rates for margin interest; Isda to follow in standard model update

Clearing away after Brexit?

This paper analyzes, from a legal perspective, the new framework, the roles and responsibilities of the European Central Bank, ESMA and the European Commission, and the possible outcomes for UK CCPs once Brexit is complete.

Central clearing rates for CDSs hit record high

A volatile 2020 pushed more single- and multi-name contracts to central counterparties

US Treasuries: a venerable market in need of fresh thinking

The world’s most important market has evolved ad hoc; bringing order to it will be no small task

LCH, JP Morgan question BoE’s CCP resolution powers

Isda AGM: UK proposals give central bank broad powers to intervene in winding up stricken clearers

CCP open access meets ‘disappointing’ death in UK

All eyes turn to EU’s review of listed derivatives clearing, after battle is lost in UK

The US Treasury’s great market makeover

Changes to regulation will need to take account of evolving market structure

The Giancarlo spirit: wobbling but not falling

The burden of US extraterritoriality rules may be easing

Accurate RFR hedges face liquidity trade-off, participants say

Isda AGM: Aligning swaps with assorted cash market conventions requires users to weigh liquidity cost

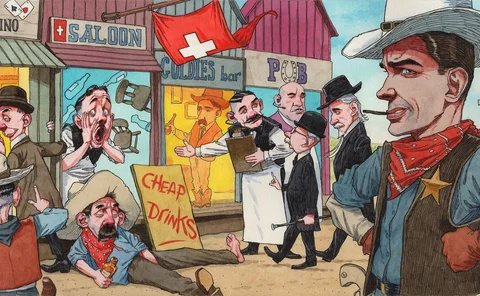

Credit Suisse and the Wild West of synthetic prime brokerage

Industry insiders describe a frontier business with few rules – and plenty of questionable practices

Goldman’s swaps clearing unit boosts client margin by $1.2bn

The top eight FCMs accounted for 95.8% of total client required margin, down 96.4% YoY

Yen swaps users stuck in clearing Catch-22

Lack of access to client clearing at JSCC poses problems for US buyers of Japanese government bonds

Net losers? Benefits of clearing US Treasuries are cloudy

Practical obstacles and questionable netting benefits muddy the path to a clearing mandate, argues economist

JSCC incurred 311 IM breaches in 2020

IRS service experienced the largest breach last year

After Archegos, Credit Suisse clients tap rivals for clearing

Swiss bank is said to have lost clearing business amid uncertainty over its future

Euro swaps clearing showdown pits banks against Brussels

Forcing swaps clearing to Frankfurt would play into hands of US rivals, say European dealers

EU firms run the most euro swap risk – Eurex exec

LCH data shows trades with at least one EU counterparty make up a quarter of volumes, but German CCP claims EU firms run more risk

LCH SA skin in the game fell in Q4

In contrast, pre-funded clearing member contributions to the default funds increased 10% to €6.1 billion

One FICC member paid record $102bn to cover dues in Q4

Previous highest payment obligation of a single participant was $77 billion in size