CCP

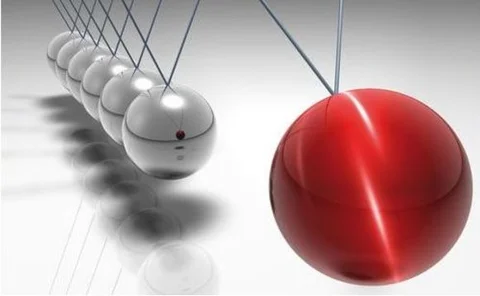

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

Podcast: Andrew Dickinson on CCPs’ defence mechanisms

Trades’ size limits, membership rules and more transparency key to avoid another CCP default

CCP risks, Sonia shift and CVA carve-out

The week on Risk.net, January 4–10, 2020

European CCPs home to 241 non-bank clearing members

Majority of non-financial counterparties are energy and power firms

Small, speculative clearing members – are they worth the risk?

CCPs need new tools to scrutinise their members, for everyone’s good health

Volume pop leads to higher IM at Ice Clear Europe CDS

Open interest in CDX contracts increased 78% in first nine months of 2019

One bad apple: default risk at CCPs

One clearing member's disproportionately large position increases the credit risk for all CCP members

JSCC caps member cash calls, revamps futures margin model

Clearing house set to end unlimited default fund top-ups for futures clearing

IM calls rocket at LCH’s repo service in Q3

Peak aggregate initial margin call of €462 million in third quarter

SwapClear model update causes IM hike

Maximum aggregate IM call for Q3 was £3.7 billion

EU snubs plan to delay CCP open access rules, for now

Attempt to squeeze delay into crowdfunding rules fails, but Mifid review provides last chance

Eurex: from EQD clearing specialist to all-rounder

Initial margin for equity derivatives makes up 41% of total, down from 63% four years prior

Singapore’s banks eye LCH membership

London CCP’s move to clear for stranded SGX clients pays off, amid broader Apac membership push

Leaked email reveals new assault on CCP open access rules

Largest group in European Parliament wants to shoehorn delay into crowdfunding legislation

Will uncleared margin rules change the FX landscape?

As the next phases of uncleared margin rules come into force, there will be an economic driver for more clearing of FX. By Phil Hermon, Executive Director of FX Products at CME Group

Germany scrambles to shut the door on Mifid open access

Finance ministry will face fine timing to reverse clearing rule during its EU presidency

EU derivatives markets highly concentrated

CCPs hold 41% of interest rate derivatives notional exposures

How pre-trade IM calculation can optimise and reduce collateral drag

With firms under pressure to make their systems compliant with uncleared margin rules (UMR), the increase in margin requirements has put further strain on the availability of high-quality liquid assets. Mohit Gupta, senior product specialist at Cassini…

Clearing experts fear tough EC stance on Emir 2.2

Industry disappointed final Esma advice did little to dial back on burdensome equivalence rules

JSCC had a top margin breach of ¥114m in Q3

Three backtesting exceptions disclosed for 12-month period to end-September

CCPs, margin ease and equity option freeze

The week on Risk.net, November 23–29, 2019

Clearing house power-downs raise fears among members

Banks question CCP resilience to system outages, as debate swirls over non-default losses

Lifetime achievement: Benoît Coeuré

Risk Awards 2020: The departing ECB executive has helped transform eurozone financial markets

Fintech start-up of the year: Baton Systems

Risk Awards 2020: With four million FX trades since launch, the “institutional PayPal” now aims to free trapped margin

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…