Central banks

Russian banks draw over 3trn rubles at 1-day repo auction

Country’s central bank allotted full amount on offer, the highest amount since 2014

Regulators moot public utility to tackle FX settlement risk

Idea floated as battery of initiatives vie to address slowing use of PvP services

Single-name CDS trading bounces back

Volumes are up as Covid-driven support fuels opportunity for traders and investors

Buy-side rates traders staying on sidelines after wild October

Funds cautious after staggering collapse of the year’s steepener trade

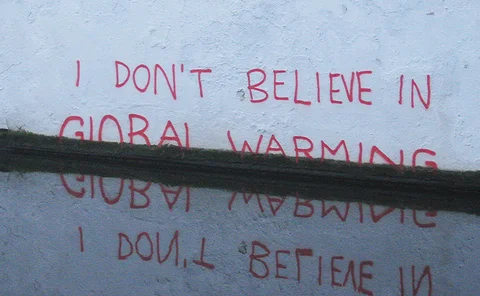

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

RMB house of the year: Standard Chartered

Asia Risk Awards 2021

EU banks eye debt issuance as central bank funding winds down

The projected increase would not be sufficient to replace TLTROs maturing in 2023, EBA report finds

Time for BoE to rethink the leverage ratio

The disparity of treatment keeps UK banks on an unlevel playing field

Deutsche leads eurozone banks on exempted exposures

German bank increased central bank reserves currently excluded from leverage ratio the most in Q1

BoE relief waives record £718bn off UK banks’ leverage exposures

On average, the UK leverage ratio of the top five lenders stood 80bp points higher than the CCR iteration in Q1

Clearing away after Brexit?

This paper analyzes, from a legal perspective, the new framework, the roles and responsibilities of the European Central Bank, ESMA and the European Commission, and the possible outcomes for UK CCPs once Brexit is complete.

Basel would readjust leverage ratio if reserves exempted

Basel’s Rogers says permanent relief for central bank reserves should lead to higher minimum ratio

SocGen’s cash pile grew to €163bn in Q1

Central bank deposits surge while other HQLAs shrink

Traders say BoE green bond purchase scheme could sap liquidity

Updated plan could spike market volatility – harming not only brown bonds, say dealers

Options trading – Real-time tools evolve as ‘butterfly effects’ take flight

Michael Hollingsworth of Cboe Data and Access Solutions discusses the factors accelerating change in the options market and explains why buy- and sell-side participants are demanding a more nuanced view on options pricing and risk management data

How sovereigns learned to live with two-way CSAs

Some say new collateral terms ensured access to markets during last year’s meltdown

Top 10 op risks 2021: geopolitical risk

Stimulus unwind, Covid nationalism and regime changes spell volatile operating environment

Barclays cut liquidity buffer in Q4

High-quality liquid assets fall 19% quarter on quarter

Banks’ claims on the public sector up a third post-Covid

Own-country debt and reserves climbed 44%

Top CCPs invest little clearing member cash in securities

Cash payments of initial margin and default fund contributions are typically placed with central banks

US Fed facility bought Libor bonds with ‘weak’ fallbacks

Industry surprise over purchase of floaters linked to doomed benchmark

EU banks’ reliance on ECB loans has grown in Covid’s wake

Central bank funding accounted for 14.5% of Greek banks’ liabilities in September

Post-Covid crisis, EU banks have thin dollar liquidity buffers

Dollar LCRs declined between March and June

BoE warns banks: start preparing for a higher carbon price

Risk Live: stress tests should assume rising carbon price, regardless of government policy, says Breeden