Capital Requirements Directive

EBA relaxes modellability hurdles for market risk capital

Flexibility granted for assessing NMRFs on options, but constraints remain on committed quotes

Leverage ratio squeeze hits options trades

With clearing banks constrained by leverage limits, prop traders fear options market lockdown

Leaked EU document casts doubt on leverage ratio relief

Several MEPs oppose leverage exemption for sovereign bonds, but some want SA-CCR fast-tracked

Eurozone banks fear market risk capital hike due to Covid-19

Hopes that ECB will fix double-counting as VAR breaches rise on market volatility

EU banks seek FRTB delay, citing ‘strain’ of virus

Firms want leeway to fight market mayhem, minus burden of new reporting rules

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

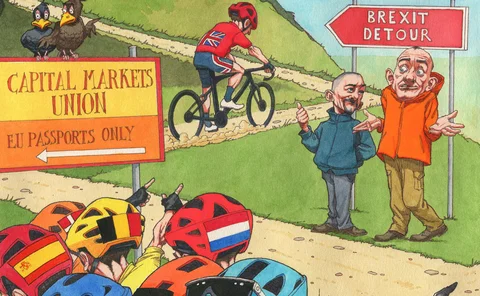

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Barclays to shrink capital buffer

Bank targets excess capital over regulatory minimum of 100 basis points by year-end

PRA’s Woods: ending capital deductions for IT is ‘dubious’

Regulator signals potential divergence between UK and EU capital rules after Brexit transition

UniCredit to liberate capital on Pillar 2 change

Bank targets 50% payout ratio

BNPP faces €67bn RWA hike under Basel III

Executives say ongoing capital generation and Pillar 2 changes will help keep CET1 ratio stable

US sidetracks bid to end European CVA exemption

Fed’s change to SA-CCR capital renews EU industry calls to preserve carve-out

EU banks eye savings following Pillar 2 update

ECB estimates CET1 relief of 90 basis points

IFRS 9 transitional measures saved EU banks €22bn

Four Greek banks claim €1.2 billion of capital relief on average

ECB favours higher countercyclical buffers

Releasable buffers only make up fraction of required capital

IFRS 9 capital relief saves Lloyds £768m

Phase-in measures ameliorate CET1 hit of higher loan-loss provisions

EBA’s Campa: reduce Pillar 2 charges to offset output floor

Bankers plead for smaller capital hit and more predictability on implementation of Basel III

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

Double trouble: don’t blur FRTB deadlines, warns ECB

Ignoring reporting model deadline could muddy capital approval cut-off

Denmark, Slovakia hike countercyclical buffers

Eight countries have increased their CCyB year-to-date

Watchdogs ask EC to delay repo haircut floors. Will it?

EBA says hedge funds will skirt the rules, but Basel and FSB want haircut minimums in place

Over two years, UK G-Sibs levered up in contrast to EU peers

But UK CRR leverage ratios still higher than eurozone rivals

When regulators become nationalists

EU’s new treatment of bank software assets is partly a response to global competitive pressures

Enria: no reason for EU to deviate from Basel output floor

ECB supervision chief urges lawmakers to implement contentious Basel III model constraints