Capital Requirements Directive (CRD)

EBA highlights shortfalls in Pillar III disclosure

A report issued this morning says many banks are failing to report market and credit risk adequately

Industry slams 'unworkable' Esma proposals on indirect clearing

Clearing members would be forced to guarantee trades executed by their clients' clients - on terms the member firms have not agreed

Q&A: Christian Clausen on bank capital, systemic risk buffers and bail-in debt

Hitting the buffers

Prices diverge as CVA exemption remains in limbo

Dealers face pricing headache as they wait to see whether Europe's version of Basel III will exempt corporate customers from the CVA capital charge

Swedish banks braced for home loan capital hike

A weighty issue

OpRisk Europe: Harmonised rules must preserve flexibility, panellists say

Speakers at OpRisk Europe conference call for balance between harmonisation and national freedom

Securitisation market seeks SPV clearing carve-out

Securitisation would be "a lot less viable" if SPVs do not qualify for clearing exemption, says Isda

Reviving securitisation: regulators send mixed messages

Reviving securitisation

Asian banks disadvantaged by Basel Accord – Asean Risk 2012

The Basel III Accord has been framed purely to fix the failures in the US and European banking system and is placing an unfair burden on Asian financial institutions, according to speakers at Asean Risk conference.

Cyprus presidency fears add urgency to CRD IV talks

Ecofin votes through new regulatory regime - and final amendments appear to give UK extra freedom - but work remains before Danish presidency ends on July 1

Corporate trades should not face CVA charge – Risk.net poll

Two-thirds of respondents think trades with corporates should be exempt from Basel III's CVA capital charge

CoRep and FinRep: a "Frankenstein's monster" of reporting

Mind the language gap

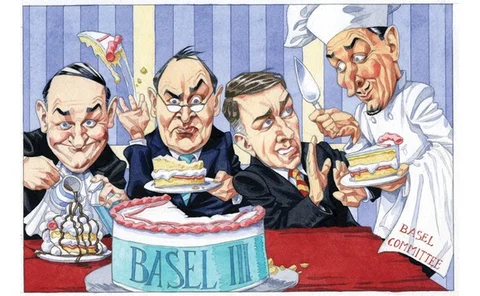

Different preferences create divided implementation of Basel III

A matter of taste

Italy could face more swap terminations

Italian politicians claim Morgan Stanley's swap termination in January will be a one-off - but dealers say Italy's debt office is subject to other clauses that could have the same effect

Risk Annual Summit: Buy-side firms call for clearing changes

Eligible collateral for CCP margin needs to be reviewed – and regulators also need to ensure the clearing exemption for some end-users is not negated by Basel capital rules, say buy-side firms

Risk Annual Summit: Deutsche credit risk head questions CRD IV timeline

Banks have nine months until elements of Basel III are due to come into force, but details of implementing legislation are still being debated

ECB compromise on Basel III adjustments gets mixed response

An ECB proposal for the European Systemic Risk Board to have oversight on whether European regulators can adjust Basel III for macro-prudential purposes gets a mixed response from central bankers

New CRD IV draft exempts sovereign trades from CVA capital charge

The latest council draft adds a CVA capital charge exemption for sovereign derivatives transactions – potentially removing one of the big unintended consequences of CRD IV, participants say

Del Missier: "status quo won't work" for long-dated trades

Dealers will have to change the way they approach long-dated derivatives business, says Barclays Capital’s Jerry del Missier

European capital rules could squash CVA feedback loop

European capital rules could squash CVA feedback loop

Eurex to offer full segregation in March launch of OTC clearing

Eurex Clearing plans to be the first OTC clearer to offer full segregation of collateral when it launches in March - demand has risen since MF Global collapse

Reconsidering the LCR

Reconsidering the LCR