Call options

Options liquidation can be costly. How costly?

New model uses open interest and volume data to calculate the expense of selling an options portfolio during times of stress

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

Hedge funds push yen options bets to next BoJ meeting

Target shifts as vol punts on change to rates policy fall flat

MSIM option strategy set for payout

Manager has spent over $400 million buying options that have yet to generate returns – until now

UK budget gives sterling options traders a wild ride

Reaction to tax cuts sparks most active week for GBP/USD options traders since Brexit negotiations

Virtus, FT boosted sold single-stock calls amid Q2 contraction

Counterparty Radar: US mutual fund managers cut $4.3 billion in individual equity options

T Rowe, JP Morgan AM defy equity index options retreat

Counterparty Radar: US mutual funds cut $15.4 billion from their books in Q2 2022

Optimal exercise of callable bonds

Citi quants and structurers present a term-structure model for callable bonds' work

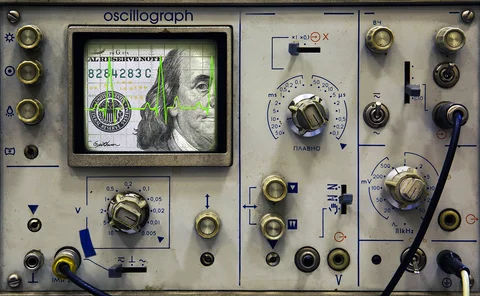

Return of volatility revs up FX options market

Macro disruption hikes volatility for eager dealers, however liquidity and spread compression remain a concern

Mutual funds dialled up bullish bets with stock options in Q1

Counterparty Radar: Market contracted by $3.9 billion as US managers decreased sold calls

Power-reverse to the future: falling yen revs up PRDCs again

Pressure on Japanese unit sparks revival in power-reverse dual currency notes

Hedge funds pile into renminbi FX options

Investors target call spreads and RKOs in what traders say is one of 2022’s most profitable trades

MSIM’s baffling $400m options splurge

Funds owned or advised by the manager have spent vast sums on a USD/CNH strategy that appears not to have paid off

US funds sold single-stock calls, bought puts ahead of downturn

Franklin Templeton, BlackRock, Calamos built defensive positions in Q4 2021

Deep hedging: learning to remove the drift

Removing arbitrage opportunities from simulated data used for training makes deep hedging more robust

Jarrow and co find a better way to spot stock market bubbles

Quant team’s options-based approach avoids pitfalls of historical data dependence

Structured products house of the year: Goldman Sachs

Asia Risk Awards 2020

Asia collar financing surges on back of Covid-19 volatility

Options-based structures gain ground on margin loans – and dealers say it may be a structural shift

Shale firms pump hedge books for liquidity lifeline

Lucrative hedge portfolios offer promise of cash but unlocking residual value won’t be simple

Hedging of options in the presence of jump clustering

This paper analyzes the efficiency of hedging strategies for stock options in the presence of jump clustering.

Covering the world: global evidence on covered calls

Typical covered call strategies may be decomposed, using a risk and performance attribution methodology, into three components: equity exposure, short volatility exposure and equity timing. This paper applies that attribution methodology to covered calls…

Bankers warn first TLAC bail-in could spark market shock

Regulators urged to clarify treatment of bail-in bonds under both TLAC and NSFR rules

Asia investors eye fund-linked structures amid US rate rises

Principal-protected fund-linked products on the rise as fixed-income investors seek safety

Approximation of the price dynamics of heating degree day and cooling degree day temperature futures

This paper proposes an approximation that makes the price dynamics of HDD and CDD temperature futures linearly dependent on the underlying temperature.