Buy side

My kingdom for the right copula

Copulas can still deliver if chosen with due attention to intuition and data, says quant fund chair

March’s clearing failures give new life to an old idea

Futures industry snubbed chance to build post-trade utility before. Now, it really needs one

Credit curves – Crucial in a crisis

The peak of the Covid-19 crisis in March 2020 underlined the need for superior data; when the tide goes out, the shortcomings of some datasets are cruelly exposed. Banks and asset managers will need to have confidence in the data fuelling their models…

Held in suspense: late futures orders blamed for Covid meltdown

Buy-side use of average pricing contributed to rash of failed trades and give-ups last March

Investment house of the year: Amundi

Risk Awards 2021: When the pandemic hit, Amundi moved quickly to cut risk and raise liquidity

Derivatives client clearer of the year: JP Morgan

Risk Awards 2021: Bank avoided tech snags and margin call surprises that plagued peers during crisis

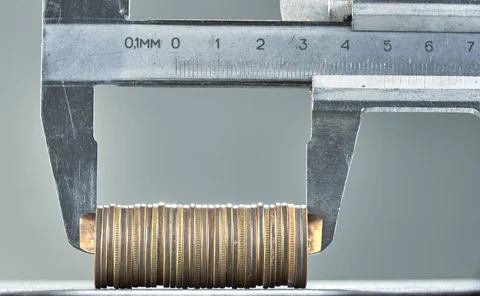

Futures industry weighs need for new post-trade utility

Three large FCMs say standardising trade allocations could prevent a repeat of breaks seen during Covid volatility

Funds steering clear of bets on Libor timeline after losses

Despite FCA assurances, most actively traded swap bases have not yet widened back to November levels

European funds fret over merits and risks of ethical labels

Managers unsure whether to “aspire to” or “run away” from new ESG classifications for funds

EU fund managers confused by new ESG designations

Vague rules leave managers unsure which categories to apply to their funds

End ‘senseless’ ban on midpoint trading, asset managers urge

Investors decry European rule that forces them to trade some equities in whole tick sizes

ETF options: the market’s latest credit hedge

Investors look to derivatives on fixed income exchange-traded funds to manage credit risk exposure

US pension fund teams up with academics to cut through ESG fog

State fund and MIT’s business school look to improve ESG data and to reflect all investors’ views

Nascent green repo market promises new market ‘ecosystem’

Market participants see demand for repo backed by green collateral

Trading heads call for reform of double volume caps

Asset managers endorse UK move on caps and back changes to EU’s unloved share trading restrictions

Bonds fall from favour as shock absorbers for equity losses

Ultra-low rates force investors to rethink role of fixed income as diversifier

Guy Debelle on the FX Global Code and the rise of the buy side

Asia Risk 25: Code’s creators considering updates to sections on last look and pre-hedging

FCMs fret over S&P 500 options settlement changes

Dealers say CME, Cboe settlement time shift for S&P 500-linked options causes risk management headache

Markets search for FX factor as rates fall flat

Traders signal shift to currency strategies, but is it passing fad or permanent fixture?

Margin rules snare FX options users

US banks forced to post margin on ‘naked’ trades, with buy-side firms soon to follow

Algo users seek apples-to-apples info

BIS study raised concerns; standards now a work in progress at GFXC

Diginex chief on taming the Wild East of cryptocurrencies

Asia Risk 25: Singapore-based digital exchange wants to bring respectability – and regulation – to the sector

Machine learning will create new sales-bots – UBS’s Nuti

Technologists working to automate indications of interest from trading desks

TradingHub: client data trove offers jump on market abuse

Surveillance firm already using aggregate info to tackle best execution questions