Black-Scholes

The damped Crank–Nicolson time-marching scheme for the adaptive solution of the Black–Scholes equation

This paper deals with error estimators and mesh adaptation for a space-time finite element discretization of the basic Black-Scholes equation. An interesting modern numerical mathematical technique for a fundamental pricing equation in finance is…

Cutting edge introduction: Funding holes in Black-Scholes

HSBC quant builds funding costs and haircuts into Black-Scholes option pricing formula

Funding in option pricing: the Black-Scholes framework extended

Wujiang Lou shows the impact of funding costs on option valuation

Regulatory costs break risk neutrality

Regulations impose idiosyncratic capital and funding costs for holding derivatives. Idiosyncratic costs mean that no single measure makes derivatives martingales for all market participants. Chris Kenyon and Andrew Green demonstrate that regulatory…

Energy trading firms may rue the decline of quants

New areas for quant research are in abundance, but resources are not

Quants: how they shaped the modern energy market

Application of quantitative analysis to energy was far from smooth

Risk reaches 25-year anniversary

In celebration of our 25th anniversary this year, Risk re-publishes a landmark article by Fischer Black, offering a critique of the Black-Scholes model

In defence of FVA – a response to Hull and White

In defence of FVA

Traders close ranks against FVA critics

Traders v. theorists

Quanto adjustments in the presence of stochastic volatility

It is well known that the quanto adjustment in the drift of the underlying has a significant impact on the prices of quanto options. Alexander Giese points out that an additional quanto adjustment in the underlying’s volatility needs to be considered in…

Profile: NYU’s Robert Engle on volatility, liquidity and systemic risk

An Arch economist

Sponsored statement: Ito33

Which model for equity derivatives?

Repricing the cross smile: an analytic joint density

Repricing the cross smile: an analytic joint density

Q&A: Myron Scholes on LTCM, crisis lessons and the value of intermediation

Quants' golden age

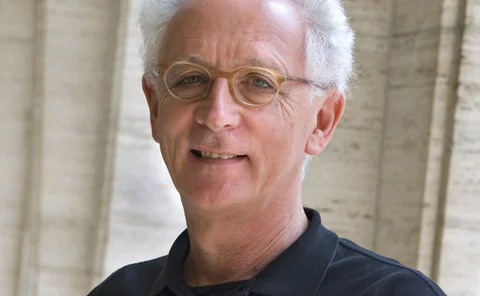

Lifetime achievement award: John Hull

Risk awards 2011

Volatility: the next mainstream asset class?

A volatile time

Technology provider of the year, Asia – Numerix

For its continued expansion in China and South Korea as well as its established business in Japan, Numerix is the Structured Products Technology Provider of the Year for Asia

Parameter estimation with k-means clustering

Ever since the pioneering work of Cox, Ross & Rubinstein (1979), tree models have been popular as an asset pricing method. However, statistical estimation of the parameters of tree models has been less studied. In this article, Kiseop Lee and Mingxin Xu…