Basis risk

Japan dealers hail ‘Tona First’ success

Tona overtakes Libor benchmark in yen swaps, but Tibor surge creates new basis risks

Japan’s Libor-linked structured products face basis menace

Lack of readiness for compounded rates could sweep repacks onto synthetic Libor, creating swaps mismatch

NatWest gets VAR model approval as transition from Libor continues

The updated model is expected to reverse a £1.5bn increase in markets RWAs next quarter

Japan weighs benchmark options as sun sets on Libor

Dominance of risk-free rates in local swaps markets post-Libor is no foregone conclusion, dealers say

Rival SOFR conventions splinter loan market

Diverging approaches to calculating interest payments sow uncertainty and hedging concerns

SOFR phase-in for cash products sparks ‘mismatch’ fears

Official proposal for one-year transition period could lead to basis risk, participants say

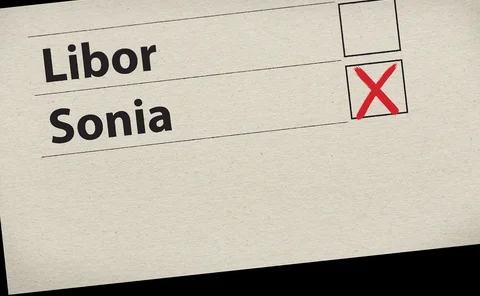

Sonia swaps surge not mirrored by futures

Popularity of short sterling futures takes shine off Sonia’s RFR succession

FCA dismisses Libor credit component concerns

UK regulator bemused by distress raised by US regional banks to Fed

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

UK financials pilot £4bn Sonia bond switch

Lloyds, Santander UK and Nationwide follow ABP with legacy bond transition

Best CVA practices in Japan

At a recent roundtable in Tokyo, banks and regulators discussed progress on credit valuation adjustment (CVA). While, in many respects, the work towards implementing best practices in the country is on track, challenges remain in resourcing and…

Libor transition and implementation – Covering all bases

Sponsored Q&A

CLO investors find silver lining in Libor’s demise

A backward-looking SOFR rate will reduce the asset-liability mismatch that sank CLO equity in 2018

A rush on Libor fallbacks to head off holdouts

Concerns that valuation changes will scare some off adoption may be accelerating Isda timeline

Dawn of CVA threatens hedging woe for Japan banks

Japan’s thinly traded CDS market will make CVA hedging challenging, dealers say

A tenth of users ‘don’t know’ if Libor death affects them, survey finds

Respondents blame low industry preparedness on lack of standardisation in treatment of fallbacks

Euro term rate likely to be OIS-based, says RFR group chair

Committed quotes “the most viable methodology”, but some insist rate creates new risks

Banks warned of capital add-ons for legacy Libor contracts

UK regulators’ letter to firms could be followed by Pillar 2 charge to speed transition to Sonia

Ripple effect: The impact of moving away from Libor

Sponsored Q&A

Ibor transition valuation and risk management considerations

The impending move from interbank offered rates to alternate reference rates will require important changes to many valuation and risk management processes and infrastructure. EY Financial Services’ Shankar Mukherjee, Michael Sheptin and John Boyle…

Spotlight on auction in €114m Nasdaq clearing blow-up

Four-member auction may have turned 39% margin breach into huge default fund loss

Esma: Eonia can be used in CSAs after 2020

Swaps users can avoid repapering before BMR deadline but may face basis risks