Basel III

WHAT IS THIS? Basel III is a set of bank soundness rules drawn up by the Basel Committee on Banking Supervision in response to the financial crisis. It hikes the minimum amount of capital banks must hold, introduces new leverage and liquidity ratios, and limits the use of internal models.

Endgame manoeuvre: US banks put SLR reform back in spotlight

Plan to ease Basel III brings renewed focus to impact of leverage ratio on US Treasury market

Regulators want to fix AT1s. Investors want restraint

Tweaking the instrument that regulators love to hate may be the only way to prevent its abolition

Fourteen US banks poised to benefit from curtailed market risk rule

Fed’s changes to Basel III endgame proposal would keep regional banks with limited trading activity exempt from costly FRTB requirements

Fed’s Basel III rollback gives clearing units a capital break

Client-cleared trades will be exempt from CVA charges and G-Sib surcharge calculations, says Barr

ANZ takes A$20bn RWA add-on from capital floor

Charges linked to output floor adjustment rose sevenfold in the second quarter

Progress on US banks’ EVE transparency grinds to a halt

No additional disclosures of key metric linked to SVB collapse in latest round of public filings

EU banks lose relief on model test after FRTB delay

Deferment of new trading book regime to January 2026 eats into transition period for “erratic” P&L attribution test

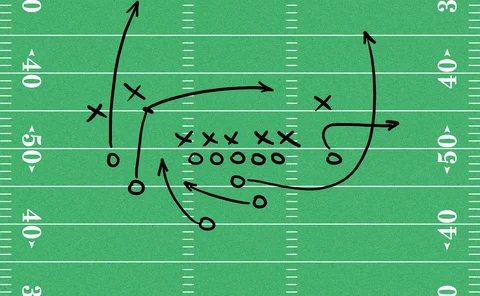

Sunday night football and the Basel III endgame

Big banks, political advocates and housing organisations are unlikely allies in race to dropkick new capital regime

Some EU banks wanted option to start FRTB on time

Representatives of member states raised possibility with European Commission at July meeting discussing the delay

US regional banks: challenges and opportunities

The authors investigate the 2023 run on US regional banks, comparing the solvency and regulation of these banks with European counterparts.

No end of peer-to-peer demand for securities financing

After Archegos, buy side turns to fellow asset managers for diversity and liquidity in securities financing and repo

For compliance risk, the big get bigger

Second-line teams have been growing at US G-Sibs – and are set to continue – while Europeans’ flatline

Four EU banks forecast capital hits from final Basel III reforms

BNP Paribas only dealer to disclose hit from FRTB

The challenges of standardised credit risk assessments for banks under Basel III

A white paper addressing the challenges of standardised credit risk assessments (SCRA) for bank exposures under Basel III, including changes to risk-weighted assets and SCRA implementation

The challenges of standardised credit risk assessments for banks under Basel III

In this white paper, S&P Global Market Intelligence addresses the challenges of the standardised credit risk assessment (SCRA) approach for bank exposures under Basel III, including changes to risk-weighted assets and SCRA implementation.

Cyber insurance costs still rising, say big banks

Op Risk Benchmarking: Cost of covering same exposure as last year now “somewhat” or “significantly” higher

Does Basel’s internal loss multiplier add up?

As US agencies mull capital reforms, one regulator questions past losses as an indicator of future op risk

US Treasury official calls for SLR relief during market stress

Under Secretary Liang also urges scrutiny of “artificial incentives” for Treasury futures in 40-Act rules

Why FRTB models are on the edge of extinction

With only four banks known to be applying to use internal models for market risk, the fate of advanced modelling looks precarious

FCM-style client clearing comes to Europe

Eurex and LCH among CCPs ready to adopt new agency model aimed at easing bank capital

Op risk managers say models will survive phase-out of AMA

Risk Live: Supervisory focus expected to shift to Pillar 2 capital, and ILM may make a comeback in Europe

Attention shifts to US, UK after European Union postpones FRTB

Risk Live: Global timeline still unclear, with banks hoping lawmakers will use delay to soften rules

Capital rules explain leverage craving in US bank risk transfers

Tougher requirements have led to conservative structuring and lower coupons

Loss of diversification benefits ‘will drive higher FRTB charges’

Independent study backs industry’s claims of significant rise in market risk capital requirements