Basel III

WHAT IS THIS? Basel III is a set of bank soundness rules drawn up by the Basel Committee on Banking Supervision in response to the financial crisis. It hikes the minimum amount of capital banks must hold, introduces new leverage and liquidity ratios, and limits the use of internal models.

Basel trading book review delayed

Fundamental review of Basel trading book rules may not begin in earnest until March 2012

Complexity Basel 2.5's biggest problem, Risk.net poll finds

As banks prepare for year-end introduction of new trading book rules, poll respondents single out the framework's modular approach for criticism

Video: BoJ’s Hiromi Yamaoka on the failure of global rulemakers to learn from Japan’s ‘lost decade’

Experience from Japan’s financial crisis in the 1990s showed the importance of maintaining the core intermediation function of banks by not placing an excessive regulatory burden on them, a lesson that US and European regulators may have failed to grasp,…

Sovereign debt crisis undermines LCR, critics say

Bankers at Eurofi conference in Wroclaw, Poland call for a wider range of assets to be eligible for Basel III's liquidity coverage ratio

The product no-one wants to sell: portability held up by lack of rules

Under-the-counter derivatives

Credit Risk USA: Basel trading book regime attacked by dealers

CVA charge and Basel 2.5 rules incoherent and over-complicated, say dealers

CRD IV proposals do not deviate markedly from Basel III, says EC's Faull

Jonathan Faull dismisses suggestions CRD IV will lead to uneven application of Basel III

ICB capital levels would hurt UK banks, critics say

Report recommends a worst-case capital level of 22.5% for large ring-fenced retail banks and UK-headquartered systemically-important banks

UK's ICB report a further complication for banks

The ICB's final report gives banks another layer of capital requirements to deal with

ICB's ring-fencing may spell the end for free banking

Industry experts fear ring-fencing of banks' retail operations as proposed in the ICB's interim report may spell the end for free banking in the UK

Basel Committee's Walter dismisses reports of LCR overhaul

Basel Committee is working on criteria to decide what counts as a liquid asset, but secretary general says no decisions have yet been taken on how – or whether – to change the LCR

Australian regulator moves to implement Basel III two years early

The Australian banking regulator has proposed the country’s banks meet new Basel III capital and liquidity rules two years ahead of G-20 commitments. The proposal has drawn immediate criticism from the Australian Bankers’ Association

IIF warns Solvency II risk charges may lead to imprudent asset allocation by insurers

IIF warns Solvency II risk charges may lead to imprudent asset allocation by insurers

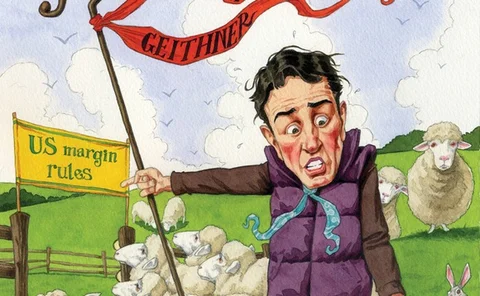

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

CVA's cousin: Dealers try to value early termination clauses

Adjustment anxiety

Basel III liquidity rules shaking up the corporate deposit market

Deposit(ive) thinking

CVA hedging: a false sense of security

Quo vadis, CVA?

Risk Japan 2011: Japan, Europe need to team up to address Dodd-Frank extraterritoriality

Speakers on a panel at Risk Japan 2011 in Tokyo on August 30 debated the effects of international regulatory developments on Japanese financial institutions. Some parties believe Japan needs to team up with Europe to push back on Dodd-Frank…

BBVA given deadline to improve AMA model

BBVA has been given until December 2011 to make improvements to its AMA model by the Bank of Spain, or will not obtain the capital savings the AMA allows

IIF calls for co-ordination in banking and insurance regulation

In its latest report, the IIF calls for cross-sector co-ordination in banking and insurance regulation

Risk.net poll: regulatory changes are not making compensation more risk-based

Basel III's higher capital levels mean "bankers' pay will come down"

Indian banks adequately capitalised for Basel III – Shyamala Gopinath profile

The outgoing deputy governor of the Reserve Bank of India, Shyamala Gopinath, is confident that Indian banks have the necessary capital cushion to absorb the additional requirements of Basel III.

Risk & Return Australia 2011: Co-ordinated supervision critical for global financial stability

Speakers at Risk & Return Australia 2011 believe the ability of supervisors to implement regulation around the world in a consistent manner is the most critical component to financial regulatory reform. They also believe the timeframe for new rules needs…