Basel II

NSFR consultation: industry awaits derivatives fix

Possible fixes under consultation don’t go far enough, say banks

Unskewed incentives: making governance work

EIB model head explains a four-step process for putting risk at the centre of governance efforts

A practical maturity assessment method for model risk management in banks

This paper proposes a qualitative method to assess the maturity of model risk management practices within banks.

Japanese banks eye phased CVA introduction

Working group reports “growing need” for valuation adjustment but cherry-picking fears persist

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

Volatility of IFRS 9 loss estimates alarms lenders

Accounting model outputs wildly out of sync with those used to calculate regulatory capital requirements

Op risk family tree challenges Basel’s business line focus

Cladistic analysis shows importance of control failure, crime and fraud

Financial networks and bank liquidity

This papers is the first to link bank liquidity performance and core–periphery network structures.

Modeling the current loan-to-value structure of mortgage pools without loan-specific data

This paper presents a method for approximating the current loan-to-value (CLTV) and remaining principal structures of heterogeneous mortgage loan pools.

Firms aim to convince Basel on merits of op risk insurance

Lack of recognition in new SMA capital charge could cause market to shrink, worry insurers

Credit veteran rewrites the alphabet of risk modelling

Scott Aguais helps banks go from point-in-time to through-the-cycle, and back again

PRA frets about Solvency II internal model ‘drift’

Bank-style leverage ratio for insurers one option being discussed

Revised Basel III better reflects bank risk, research finds

Study says 2013 capital rules more in line with actual risk, but can be easily gamed

Basel II versus III: a comparative assessment of minimum capital requirements for internal model approaches

This paper provides a comparative assessment of the minimum capital requirement (MCR) in three prominent versions of the Basel regulatory framework.

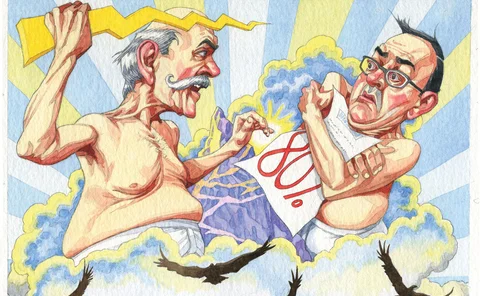

Bafin's Hufeld: op risk modelling 'almost impossible'

AMA can go, but other models will stay, Felix Hufeld tells Risk.net

Europe's new supervisory toolkit

Data and transparency remain challenges for EBA

Independent asset managers lag bank, insurer-owned peers on op risk

Capital requirements incentivise banks and insurers to enhance op risk management

Asset managers advance operational risk programmes

Independent asset management firms catching up with bank- and insurance-owned peers

Application of the convolution operator for scenario integration with loss data in operational risk modeling

This paper addresses the uncertainty in scenario analysis and produces a combined loss distribution.

And so, farewell: David Rowe's final risk analysis column

After 16 years as our risk analysis columnist, David Rowe looks back at a recurring challenge

Adios AMA: Basel proposal to bin op risk models worries banks

Firms doubtful about risk sensitivity of standardised replacement charge

Paper of the year: JD Opdyke

New technique may help limit errors in AMA capital estimates