Banks

Leverage is underestimated

Off-balance sheet funding is large, rising and not fully accounted for in leverage metrics

The open data revolution in banking falls short

Lax Pillar 3 rules are leading to inconsistent data being collected

India exchange to debut rupee derivatives settled in US dollar

Launch of onshore futures and options unlikely to dent offshore volumes, though

Dealers turn to mid-cap and EM deal-contingent trades

Premiums of more than 25% are attractive to banks battling low vol and increasing competition

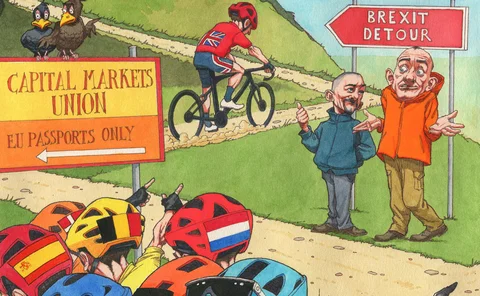

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

Top 10 op risks 2020: data compromise

Hackers, thieves and wobbly in-house data management keep this category near the top of the list

Top 10 op risks 2020: organisational change

New tech has created perennial state of flux in banking, as other kinds of shake-ups continue

Who killed FX volatility?

Beyond central bank policy, traders see a range of hidden structural factors at work

ICAAP/ILAAP – Unlocking business value from capital and liquidity assessment

Regulators consider banks’ internal capital adequacy and assessment process (ICAAP) and internal liquidity adequacy assessment process (ILAAP) important tools in managing risk. The European Central Bank’s (ECB’s) updated guidance – which came into effect…

BNP buys Deutsche’s delta one assets in latest CRU auction

French dealer lodges winning bid after missing out on flow equity portfolios last year

Credit risk – The bank data challenge in frontier markets

As the regulatory net tightens, banks working in and across frontier regions are under pressure to source and maintain more accurate data in the assessment of counterparty credit risk, but some are investing in tools to tackle the problem

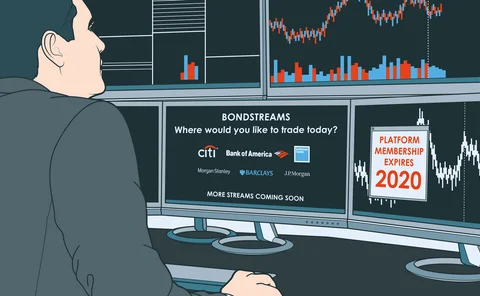

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Quant Guide 2020: programmes tap banks for teaching talent

Unis are adding machine learning and data science courses, but need instructors to teach them

Secrets and Libor fallbacks

Lenders may be forced to reveal sensitive funding data when Libor disappears

Credit data: a sharp turning point in CCP credit risk

The credit risk of CCPs is worsening, even as margin requirements rise, writes David Carruthers

ICAAP/ILAAP – How can banks improve the process?

Regulators consider banks’ internal capital and liquidity adequacy assessment processes (ICAAP/ILAAP) – important tools in managing risk

Bank disruptors: tread carefully and bend things

How BofA, SocGen, JP Morgan, Nomura, UBS and others are disrupting themselves

ICAAP/ILAAP – What’s new and what’s next?

The European Central Bank’s ICAAP and ILAAP guidelines aim to harmonise European banks’ approach to capital and liquidity management

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

Ready or not – a low-carbon economy is coming

Government and business must avert disorderly move away from fossil fuels, says Geneva Association’s Maryam Golnaraghi

Smarter trading in a fragmented world

FX Week recently hosted a webinar in partnership with Refinitiv to ask foreign exchange industry leaders to discuss geopolitical challenges, market changes and developments, and evolving technologies, and how they have shaped forex markets in Asia

Coping with uncleared margin rules – the tricks, traps and tools

A unique insight on the evolving UMR strategies of 110 banks and buy‑side firms

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…