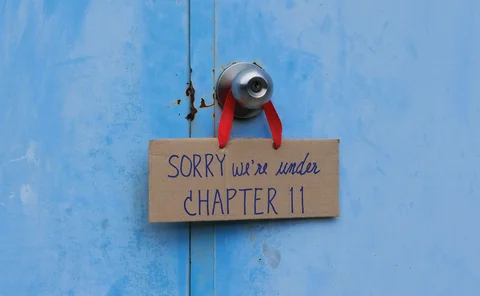

Bankruptcy

Op risk data: In fewer reg fines, US took its lumps in 2020

Also: Retro Russian embezzlement fines; Barclays slapped for lack of forbearance. Data by ORX News

The strange case of the Jet Airways bankruptcy: a financial structure analysis

The authors investigate the financial structure of Jet Airways, with the aim of understanding whether financial turbulence for an airline company can constitute an antecedent for predicting the risk of bankruptcy.

CFTC’s swap stay plan for clearing houses sparks alarm

Lawyers warn proposal could invalidate close-out netting and expose members to higher risks

The unintended impact of swap stays on financial stability

As swaps leverage shrinks, bankruptcy stay rules are not guaranteed to reduce systemic risk, says economist

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

China bond buyers tiptoe through credit analysis minefield

State backing for domestic companies is hard to gauge, as new investors are discovering

Why credit risk managers need to see around corners

The Covid‑19 pandemic – and the subsequent extreme volatility – has exposed the fragility of long-established market and supply chain systems, affecting borrowers’ ability to repay debt. David Croen, global head of credit risk products at Bloomberg,…

An alternative statistical framework for credit default prediction

This study compares the gradient-boosting model with four other well-known classifiers, namely, a classification and regression tree (CART), logistic regression (LR), multivariate adaptive regression splines (MARS) and a random forest (RF).

Crisis exposes flaws in US financial stability regime

Former Fed chair Yellen calls for reform after failure to curb corporate leverage ahead of Covid-19

China regulator to outline legal thinking on close-out netting

Coronavirus could delay things, but authorities are taking small steps on a thorny issue

Central counterparties: magic relighting candles?

In this paper, the rules of selected major CCPs (LCH, CME, Eurex and ICE) are reviewed for both their end-of-waterfall procedures and the rights granted to clearing members in end-of-waterfall scenarios.

‘Living wills’ show some G-Sibs will be simpler to resolve

Four big banks reported fewer wind-up entities in 2019 resolution plans compared with 2017

Buy-siders eye ways to get ahead of US resolution stay rules

Come July 1, asset managers will be unable to dump derivatives as a G-Sib is unwound. Lawyers are standing by

A fifty-year retrospective on credit risk models, the Altman Z-score family of models and their applications to financial markets and managerial strategies

This paper reflects upon the evolution of the Altman family of bankruptcy prediction models, as well as their extensions and multiple applications in financial markets and managerial decision making.

China’s regulatory shake-up offers hope on close-out netting

New merged body will draft netting rules, with signoff from central bank, sources say

SEC’s Stein sounds alarm on portfolio margining

Comment period on single-name CDSs is covert attempt at rulemaking, regulator says

To be resolved: the FDIC and the future of bank failure

Will Jelena McWilliams finally nail down the FDIC’s role as a resolution authority?

Bridge to nowhere: gaps in Treasury G-Sib bankruptcy plan

US bankruptcy-first approach needs more thought on emergency liquidity, say experts

Citi hits hurdle in bid to apply China close-out netting

Chinese derivatives counterparties refuse to amend documentation to apply a netting opinion

US Treasury hands CCP resolution powers to FDIC

Mnuchin regulatory review explicitly refers to FDIC as receiver under a Title II resolution

Holes in the net: lawyers split over China netting opinions

Law firms are offering close-out netting opinions, but not everyone agrees it is possible

Bailout obsession holds back US CCP resolution regime

Dodd-Frank leaves legal uncertainty, but proposed alternatives could be even worse

Financial and nonfinancial variables as long-horizon predictors of bankruptcy

This paper assesses the predictive ability of financial and nonfinancial variables for a long horizon in a large cross-sectional sample of Finnish firms

Q&A: FDIC’s Hoenig warns on daily settled swaps

FDIC vice-chair on leverage-cutting schemes, TLAC and TBTF