Asset management

BlackRock slashes book as IR swap market volume rises

Counterparty Radar: Pimco’s book surpassed $40 billion in Q2, growing to half of mutual fund space

US mutual funds pulled back from repo market in Q2

Counterparty Radar: Cash borrowing fell to lowest level since 2020; JP Morgan remains top dealer

PGIM grows sovereign-referencing CDS book in falling market

Counterparty Radar: US mutual funds cut $2bn in single-name swaps in Q2, making largest reductions in SSA trades

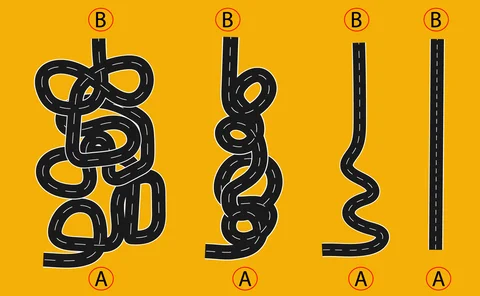

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

Virtus, FT boosted sold single-stock calls amid Q2 contraction

Counterparty Radar: US mutual fund managers cut $4.3 billion in individual equity options

Nomura’s swaptions volume jumps in Q2 on Pimco trades

Counterparty Radar: Japanese bank triples size of US mutual funds book despite market contraction

T Rowe, JP Morgan AM defy equity index options retreat

Counterparty Radar: US mutual funds cut $15.4 billion from their books in Q2 2022

Top Fed watchdog supports non-bank Sifi designation

Vice-chair Barr complains regulators lack “even basic data” on some areas of shadow banking

HSBC claims top FX forwards spot as US banks fall back

Counterparty Radar: Morgan Stanley slips for first time since Q2 2021 amid wider volume decline

Could a cold collateral winter be coming for pension plans?

UK LDIs passed an early test from rising rates, but margin call pressure is mounting

Uncertainty over ECB’s TPI muddies monetary and fiscal impact

Analysts say anti-fragmentation tool exposes long-standing flaws in EU fiscal framework

‘Very little support’ for a US Treasury clearing mandate – Isda

Dealers and clients prefer carrot to stick in efforts to improve Treasury market liquidity

The private markets dilemma faced by asset owners

Demand for private markets has seen continued growth. Shar Kassam, vice-president at Nasdaq, and head of Nasdaq Asset Owner Solutions, explores why market volatility has led to additional considerations for portfolio construction, cashflow and liquidity…

PGIM leans into bought credit options, further boosts Barclays

Counterparty Radar: US mutual funds added $25 billion in net new positions in Q1 with purchased protection rising

Why database marketing is increasing in importance for asset managers

Improved market presence, product viewership and brand recognition, coupled with the ability to forge long-term community followings, is making the prioritisation of database marketing a no-brainer

Don’t just reach for the ’70s inflation playbook – CROs

Lack of inflation experience on risk teams not a concern, buy-siders say

State Street flies high in FX forwards as Goldman, Citi dive

Counterparty Radar: Goldman loses half of market share, drops out of dealer top 10

France floats U-turn on Mifid’s dark pool restrictions

Leaked doc shows UK competition threat weighs on minds of EU lawmakers over non-exchange trading

UMR phases five and six: grappling with outstanding challenges

At Asia Risk Live, held in Singapore in March, and in partnership with S&P Global Market Intelligence, three market experts discussed the outstanding challenges associated with implementing and adhering to uncleared margin rules (UMR) phases five and six

Pimco triples book as IR swaptions market nearly doubles

Counterparty Radar: Goldman Sachs nets almost all of bond giant’s Q4 growth

MSIM’s baffling $400m options splurge

Funds owned or advised by the manager have spent vast sums on a USD/CNH strategy that appears not to have paid off

PGIM credit options binge lifts Barclays, Morgan Stanley

Counterparty Radar: Insurer’s AM arm doubled its market share in Q4 2021 as bought protection swells

Basel rules mean banks can’t compete with Coinbase – Goldman

Proposed 1,250% risk weight for crypto holdings undercuts banks’ push into burgeoning market

US funds sold single-stock calls, bought puts ahead of downturn

Franklin Templeton, BlackRock, Calamos built defensive positions in Q4 2021