Asset management

R-nought is the wrong number for markets, academics say

New research suggests volatility of transmission matters more for asset prices

Andreas König’s crisis playbook meets Covid-19

Interview: Trading from home may be odd, but Amundi’s FX head was ready for other stresses

Inside March madness with Citi’s Tuchman

Interview: Trading rooms went virtual, central banks stepped up – but some platforms flopped

CSDR buy-ins – next on the regulatory chopping block?

A big jump in trade fails is adding to doubts about the EU’s settlement discipline regime

Asia moves: Ex-Vanguard Asia chief joins CLSA, Man Group names equities head, and more

Latest job news across the industry

When are index delays justified? Industry standards are vital

Relying on discretion is not sustainable, argues index executive in wake of rebalance delays

Buy side eyes outsourced trading amid Covid disruption

Pressure on trading continuity drives in-house desks to look outwards

Global macro views combine with quantitative models to produce consistent returns

The team behind River and Mercantile Group’s global macro strategy team operates under two key principles: that macro is the most important aspect of any investment decision and that decision-making should incorporate both systematic and discretionary…

Vol boosts rules-based trading services

More users – and more platforms – turn to auto-RFQs for smaller tickets

Covid-19 tumult is testing AI fund returns

Some ML strategies have coped well, but others began to struggle as panic mounted

FX swap users hope to avoid month-end crunch

Blowout in spreads prompted SSGA and other managers to limit need for hedges today

Seeing red over blue-chip swap in Argentina’s NDF fiasco

Emta protocol salve aside, peso settlement rate snafu is a warning for emerging market FX derivatives

A sea change – Driving awareness to confront climate risk

Amid a global push towards green policies, the reality of overhauling how industries worth trillions of dollars operate is causing concern. A forum of market participants and sponsors of this report discuss the levels of awareness of climate risk and its…

Hedge funds cut short US Treasury futures exposure – CFTC data

Short open interest held by leveraged participants down 23% from 12-month peak

Lighting up the black box: a must for investors?

Many contend you must be able to interpret machine learning in order to use it

At Numerai, real-world figures need not apply

AI hedge fund CEO sees the light in black-box technology

Asia moves: JP Morgan names new Apac CEO, Axa hires six heads, and more

Latest job news across the industry

Credit data: rising tide lifts fund houses – but can it last?

Strong revenue growth masks structural problems in the funds industry

FCMs clamour for formal rule on separate account margin

Costly compliance effort will be to no avail if CFTC relief expires in June 2021

Cross-border trading could suffer under IM rules

Conflicting US and EU cash reinvestment rules may force buy side to post bonds

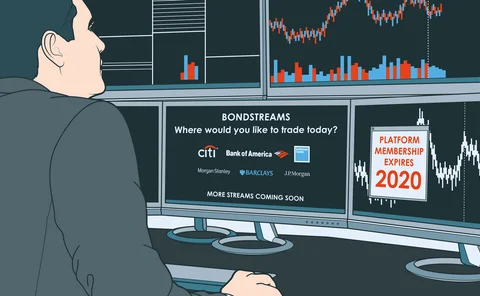

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Taming the future: Hong Kong and China

Times are tough for Hong Kong, but it remains the best-positioned financial centre to access China

Custody battle: competing tensions put IM prep in jeopardy

Conflicting custody interests and delayed docs call IM phase five readiness into question